Key takeaways:

- APIs are crucial for integrations between banks and FinTech platforms, but they can introduce security and compliance risks.

- Centralized API management helps to mitigate these risks and manage, scale, and monitor APIs in one place.

- Cloud-based API management platforms streamline development by providing built-in tools for security, monitoring, and governance.

- The scalability, security, deployment speed, and long-term costs of your FinTech system will depend on what API management platform you choose.

API management platforms offer FinTech businesses a convenient way to build, manage, and protect their APIs. This is especially important for compliance with PSD2 and other requirements.

There are many cloud platforms that can help you manage and secure your APIs, and it’s important to choose the right one based on your team’s capabilities, your security and scalability requirements, your budget, and your deployment timeline.

In this article, we talk about three leading cloud platforms you can use for API management: Google Cloud Apigee, Amazon Web Services (AWS), and Microsoft Azure. We analyze their capabilities and compare them so you can choose the best fit for your project.

This article will be useful to financial and technical leaders who need to set up secure and compliant open banking API management for their financial software. It will help you answer these questions:

- How are Google Cloud Apigee, AWS, and Azure API management solutions different in terms of security perimeter, authentication, and API management functionality?

- What are the strengths and limitations of each platform for financial services?

- Which API management solution should you choose to meet your project’s security, compliance, and scalability needs?

Contents:

Role of API management in open banking security

Open banking is a model that allows banks to securely share customer data with third-party providers through standardized APIs. This makes it possible to create all kinds of services, from financial management apps to bank account aggregators, that get data from banks to operate.

However, by using APIs as bridges, financial institutions risk exposing sensitive data. That’s why they require third-party FinTech providers to ensure their APIs are built and maintained with strong authentication and authorization mechanisms (such as OAuth 2.0 and OpenID Connect), robust encryption, and strict compliance with requirements like PSD2.

Without a centralized approach, managing these security and compliance requirements across multiple services and teams is error-prone and costly. This is where API management platforms come into play.

API management platforms simplify and automate many of the complex tasks involved in creating and securing APIs, such as traffic management, access control, rate limiting, request/response transformation, and analytics.

These platforms act as gateways that enforce security policies, transform data formats, manage traffic, monitor API use (API calls, error rates, etc.), and provide developer-friendly tools for building, documenting, and scaling APIs.

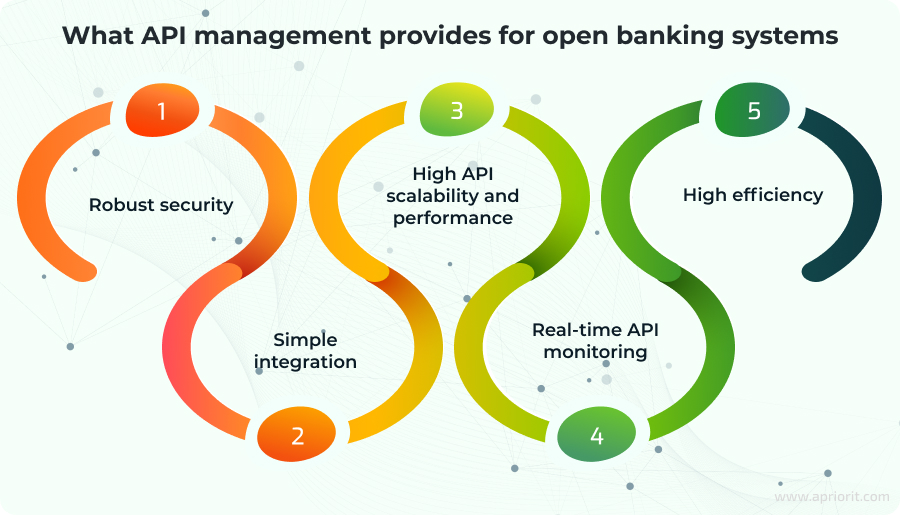

In the context of open banking, cloud-based API management platforms help financial organizations achieve:

- Security through automating compliance with standards like OAuth 2.0 and providing built-in protections against common attacks

- Integration by simplifying interactions with diverse open banking APIs by transforming data formats (for example, converting XML to JSON) and optionally offering a developer portal with clear documentation

- Scalability through enabling caching, load balancing, and rate limiting, which allows APIs to perform reliably even under peak loads without requiring major changes to backend code

- Monitoring with powerful analytics and logging tools that allow teams to debug, optimize, and monitor API usage and performance

- Efficiency through offloading much of the infrastructure management burden so development teams can focus on building business logic and frontend features

These platforms allow development teams to use pre-built cloud solutions or build their own API management architectures instead of manually verifying authorization tokens or setting up caching layers and access control policies. This makes it easier for your team to scale and secure your FinTech solution.

Currently, three of the most popular cloud platforms for managing open banking APIs are Google Cloud Apigee, AWS, and Azure. In the next sections, we take a closer look at each of these platforms and explore their key features and tools for security, authentication, and API management. We analyze their advantages and disadvantages, then provide you with a full comparison.

Need to secure your APIs?

Leverage our 20+ years of experience to deliver a protected and robust cloud API management infrastructure for your FinTech product.

Google Cloud Apigee

Google Cloud Apigee is a specialized API management platform from Google Cloud that helps you design, secure, scale, and analyze APIs. It stands out with its Apigee Open Banking APIx, created specifically to meet financial industry security standards such as PSD2. This makes Apigee one of the most ready-to-use solutions for FinTech projects.

Google Cloud Apigee offers out-of-the-box tools and functionalities, so you don’t have to use dozens of libraries and utilities to build your API management infrastructure. Let’s look at the core components of Apigee that cover most API management needs.

Security perimeter

- Built-in security policies allow your team to easily set up OAuth 2.0 authorization and enforce secure communication without manual coding.

- Request and response logging helps you meet compliance requirements by automatically tracking API activity for auditing purposes.

- Rate limiting protects backend systems by controlling the volume of incoming API requests.

- Caching reduces backend load and speeds up response times by storing frequent requests (such as account balance checks).

Authentication and access control

- OAuth 2.0 integration includes pre-configured templates and quick setup options to ensure compliance with open banking authentication standards.

- API key verification allows fine-grained access control to protect APIs from unauthorized use.

API management

- A developer portal provides easy access to API documentation and testing tools to speed up third-party and internal integrations.

- API proxies include ready-to-use templates for financial APIs to accelerate development.

- Data transformation enables conversion between different data formats (e.g., XML to JSON) for smoother frontend–backend communication.

- Version management supports multiple API versions without requiring backend redevelopment.

- Analytics and monitoring dashboards allow your team to track API traffic, errors, and performance in real time.

- Integration with Google Cloud services allows your team to connect with Cloud Functions, BigQuery, Kubernetes, and Pub/Sub for scalable, flexible architecture design.

To summarize, let’s look at what advantages and disadvantages come with Google’s open banking API management with Apigee based on these features and components.

Table 1: Pros and cons of building an API management system with Google Cloud Apigee

| Pros | Cons |

|---|---|

| Built-in OAuth 2.0, security policies, and templates support compliance (e.g., PSD2). | High long-term cost, especially for high-traffic projects. |

| Developer portal, data transformation, and versioning speed up integration. | Challenging initial setup due to advanced features and flexibility. |

| High performance due to caching, low-latency global network, and rate limiting. | |

| Real-time analytics and logs enable fast issue resolution. | |

| Tight integration with Google Cloud tools like Cloud Functions and BigQuery. |

Google Cloud Apigee is a good choice for developers and businesses without deep expertise in infrastructure management that need to quickly deploy a secure, scalable API solution that meets open banking standards. It’s particularly well-suited for FinTech projects focused on fast time to market, regulatory compliance, and global scalability.

Read also

The 6 Most Common Security Issues in API Development and How to Fix Them

Protect the sensitive data flowing through your APIs. Learn common API threats and discover how to make your APIs immune to hacker attacks in our expert guide.

AWS API management

AWS offers a comprehensive suite of services for managing APIs. Unlike Google Apigee, AWS doesn’t provide a ready-made solution specifically designed for open banking standards. However, AWS provides many tools that developers can use to build, secure, and configure your architecture.

Your team will need to design the infrastructure themselves, ensuring it meets regulations and security protocols relevant for your industry and region.

Let’s take a look at what a PSD2-compliant architecture made up of AWS tools may look like.

Security perimeter

- AWS WAF (Web Application Firewall) protects against web exploits by filtering incoming traffic and enabling geolocation controls.

- AWS Shield provides DDoS protection, including anomaly detection in network traffic and active monitoring.

- Amazon VPC enables subnet isolation and configuration for network security.

- AWS Security Hub automates security checks and provides alerts in one unified format.

Authentication and access control

- Amazon Cognito handles user registration and authentication, supporting social providers and OAuth 2.0.

- AWS IAM (Identity and Access Management) manages access and privileges for individual users and groups.

API management

- Amazon API Gateway supports API creation, publishing, and management similar to Google Cloud Apigee, offering features like throttling, quotas, caching, performance monitoring, and API versioning.

- AWS Lambda represents serverless computing that enables a microservices architecture for operations that do not require long execution times. It supports auto-scaling based on load.

In addition to the services mentioned above, you may need other services to add specific functionality to your API management platform. Here are some examples:

- Amazon EventBridge facilitates an event-driven architecture by routing events and configuring routing rules within the system.

- Amazon SQS (Simple Queue Service) provides guaranteed message delivery with its own message queue implementation.

- Amazon RDS (Relational Database Service) manages and operates various types of databases.

- AWS KMS (Key Management Service) manages cryptographic keys and audits their use.

For a detailed view of open banking on AWS, refer to the official AWS open banking documentation.

Now, let’s look at the pros and cons of building your API management architecture using AWS.

Table 2: Pros and cons of building an API management system with AWS

| Pros | Cons |

|---|---|

| Strong security with WAF, Shield, and Cognito (OAuth 2.0). | No built-in open banking support; custom architecture required. |

| High customization with services like SQS, EventBridge, and RDS. | Challenging configuration due to complexity of the AWS ecosystem. |

| Scalable and resilient with Lambda and global infrastructure. | Compliance setup is your team’s responsibility. |

| Broad service ecosystem eliminates the need for third-party tools. |

AWS is ideal for experienced teams who are willing to invest time and resources into designing and configuring their infrastructure for complete flexibility and control. It may not be the best choice for a fast start, but it’s well suited for custom solutions with long-term scalability in mind.

Related project

Supporting and Improving Legacy Data Management Software

Discover how Apriorit specialists improved user satisfaction with our client’s legacy system by improving its supportability and preparing it for migration to a new platform.

Azure API management

Azure is Microsoft’s cloud computing platform that offers a wide range of services for building, deploying, and managing applications at scale.

Just like AWS, Azure doesn’t offer a ready-made solution tailored specifically for open banking standards. Instead, it provides a comprehensive set of services that allow your developers to design a custom architecture according to your needs. Let’s take a look at what such an architecture may look like in your project.

Security perimeter

- Azure Firewall is a centralized network protection service that supports traffic filtering, traffic logging, and customizable rule sets.

- Azure DDoS protection safeguards your APIs against distributed denial-of-service attacks with automatic threat detection and mitigation.

- Azure Virtual Network allows the setup of isolated private networks with the option to configure both public and private subnets.

Authentication and access control

- Microsoft Entra ID (formerly Azure Active Directory) is a cloud-based identity platform that supports OAuth 2.0. The updated service includes features from Azure Privileged Identity Management, which enables management of privileged access and conditional access policies.

API management

- Azure API Management is a full-featured API gateway for creating and publishing APIs, with support for request transformation, caching, usage quotas, API versioning, and performance monitoring.

- Azure Functions is a serverless computing service that enables rapid execution of functions with automatic scaling and low latency, allowing your team to implement microservices.

Additionally, the Azure ecosystem offers services that can be useful to your API management system. For example:

- Cosmos DB processes payments in real time, with low-latency reads and writes across multiple regions.

- Synapse Analytics offers advanced analytics capabilities by extracting insights from large volumes of financial data.

- Key Vault securely stores and manages sensitive information such as API keys, certificates, and secrets used in your application.

Table 3: Pros and cons of building an API management system with Azure

| Pros | Cons |

|---|---|

| Strong security with firewall, DDoS protection, and Entra ID (OAuth 2.0). | No built-in open banking solution; architecture must be designed manually. |

| Feature-rich API management with transformation, caching, and monitoring. | Requires deep Azure expertise to properly configure services. |

| Scalable performance with serverless functions and global infrastructure. | Compliance setup is fully your team’s responsibility. |

| Flexible ecosystem with Cosmos DB, Synapse Analytics, and Key Vault. |

You should choose an Azure open banking architecture if your team is already invested in the Microsoft ecosystem, or if you need specific services. However, it’s not optimal for fast deployment and may not be the best choice for teams looking for plug-and-play open banking solutions.

Read also

Integrating FinTech APIs: Key Considerations for Security, Compliance, and Performance

Secure fast and seamless data exchange with FinTech APIs! Learn how to choose the right API strategy to ensure the compliance and security of your FinTech integrations.

Which API management system to choose: Apriorit recommendations

When choosing a cloud platform for open banking API management, it’s important to consider a range of factors. In the table below, we compare Google Cloud Apigee, AWS, and Azure based on key criteria for open banking systems:

- Regulatory compliance

- Required developer experience

- Scalability

- Monitoring capabilities

- Implementation speed

- AI and data analytics capabilities

- Cost

We also summarize which projects each option is best suited for.

Table 4. API management platform comparison

| Criterion | Google Cloud Apigee | AWS | Azure |

|---|---|---|---|

| Regulatory compliance | High (pre-built Open Banking APIx templates) | Medium (flexible, but manual setup required) | Medium (flexible, but manual setup required) |

| Developer experience | High | Medium | Medium/high |

| Scalability | High | High | High |

| Monitoring capabilities | High (real-time analytics and dashboards) | High (CloudWatch with customizable alerts) | High(Azure Monitor and analytics tools) |

| Speed of implementation | High (ready-to-use solution) | Medium (depends on team expertise) | Medium (depends on team expertise) |

| AI and data analytics | BigQuery, integrated AI tools | SageMaker, Redshift | Synapse Analytics, Power BI |

| Cost | High (under heavy workloads) | Medium/flexible (pay-as-you-go model) | Medium/flexible (pay-as-you-go model) |

| Best fit for | Fast implementation of open banking–compliant systems with minimal overhead | Experienced teams seeking full control over custom architectures | Microsoft-oriented teams or those needing advanced real-time data processing |

If you aren’t sure which option best suits your open banking system, our software architects can help you choose the right solution and build a secure, scalable infrastructure tailored to your needs.

Сonclusion

API management is critical in finance — without it, your product risks security breaches as well as issues with non-compliance, scaling, and maintenance. API management platforms allow you to manage your APIs in one place, making it easier to track, update, and secure them.

Choosing the right API management platform is just as important as properly managing the APIs themselves. Each platform introduces different strengths, limitations, and integration options.

At Apriorit, we help FinTech companies choose the right solution. Whether you need an architecture that is fast to deploy or highly customized, we can assist you in selecting the right API management platform, setting up the infrastructure according to your security and regulatory requirements, and supporting your FinTech system as it evolves.

Looking for experienced cloud developers?

Reach out to our team of developers and build a secure and efficient cloud infrastructure for your product!