Due to their convenience, mobile banking apps have transformed the way users manage their finances. With a few taps on your phone, you can access your accounts, transfer funds, pay bills, invest in stocks, and conduct other financial business. Unfortunately, this convenience comes with its own set of risks. Mobile banking apps are increasingly targeted by cybercriminals who want to exploit various vulnerabilities and steal sensitive data.

The security of mobile banking apps is directly connected to users’ trust and confidence, as these apps contain sensitive financial information. Any breach or compromise can lead to severe repercussions and financial losses. Implementing security best practices during and after development is paramount to the security of your app and the trust of your users.

In this article, we discuss the importance of mobile banking app security and the most common attack vectors in this industry. We also present our best security practices that can help in mitigating these attack vectors. This article will be useful for tech owners and product experts who are looking to enhance their existing mobile banking apps or create new applications according to the highest security standards.

Contents:

Importance of mobile banking app security

Mobile banking apps have become increasingly popular in recent years, as they offer a convenient and efficient way to manage one’s finances on the go. However, banking apps are a prime target for cybercriminals because they provide access to sensitive data, including personal and financial information.

A Juniper Research report claims that losses from online payment fraud will exceed $362 billion globally over the next five years. This alarming statistic shows the critical need to enhance mobile banking app security in the face of escalating and constantly emerging cyber threats. The primary mobile banking security risks include:

- Data breaches. Cybercriminals can exploit vulnerabilities in mobile banking apps to gain access to sensitive user data, such as account numbers, passwords, and transaction history. This data can then be used to commit fraud or identity theft.

For example, Zelle, a popular money transfer app used by major US banks, experienced a data breach that impacted millions of users in 2023. Hackers exploited a vulnerability in the app’s request money feature, stealing names, account numbers, and transaction details.

- Unauthorized access. Malicious actors can also exploit vulnerabilities to gain unauthorized access to users’ mobile banking accounts. This can allow them to transfer money, make fraudulent transactions, or even lock users out of their accounts.

For example, hackers have used SIM swapping to gain unauthorized access to users’ accounts in mobile banking apps. In SIM swapping, hackers compromise a victim’s phone number and intercept verification codes, enabling them to access and drain bank accounts.

- Malware infection. Cybercriminals can also use mobile banking app vulnerabilities to infect users’ devices with malware. This malware can then be used to steal personal information, track users’ activities, or even disable devices.

For example, in 2021, FluBot — Android malware disguised as a banking app — emerged. FluBot stole login credentials, intercepted one-time passwords, and bypassed two-factor authentication, posing lots of mobile banking security threats.

Need a mobile banking app that is resistant to various risks?

The Apriorit team will help you fulfill your vision and comply with the highest cybersecurity standards.

Now, let’s take a look at the most vulnerable places in mobile banking apps that can serve as entry points for cybersecurity attacks.

Сommon attack vectors for mobile banking apps

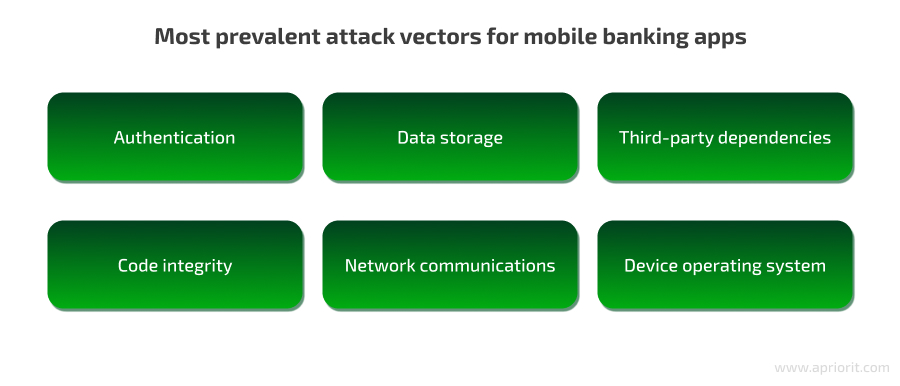

Understanding attack vectors that cybercriminals commonly employ is crucial for developers to mitigate threats and protect financial information. Any banking app can have its weak points that can let in malicious actors.

Authentication. This is the first line of defense against unauthorized access to mobile banking apps. However, weak authentication mechanisms can easily be bypassed by cybercriminals. The most common authentication vulnerabilities include weak passwords, lack of multi-factor authentication (MFA), and SMS-based one-time passwords.

Data storage. Mobile banking apps store a wealth of sensitive financial information, including account numbers, transaction history, and personal details. If this data is not properly encrypted, it can easily be accessed by malicious actors who exploit vulnerabilities in the app’s data storage mechanisms. Your application data can be exposed to threats while at rest and in transit:

- Attacking data at rest can allow attackers to gain access to the device file system or app database, enabling them to directly retrieve sensitive information without any decryption barriers.

- Cybercriminals can intercept data packets traveling between the user’s device and the app’s servers, potentially gaining access to login credentials or transaction details. They can also modify data packets to manipulate transactions, leading to unauthorized transfers or financial losses.

Third-party dependencies. Mobile banking apps often integrate third-party libraries or frameworks to enhance their functionality. However, vulnerabilities in these third-party components can be exploited to compromise overall app security.

Code integrity. Manipulating the app’s code opens doors to various threats, like injecting malicious code, altering the app’s behavior, or bypassing security controls. Manipulated code can then be used to steal sensitive user data, initiate fraudulent transactions, or disrupt the app’s functionality.

Network communications. Mobile banking apps communicate with servers to exchange sensitive financial information. If this communication is not protected by secure protocols like HTTPS, cybercriminals can intercept and eavesdrop on this traffic, gaining access to sensitive data and potentially manipulating transactions.

Device operating system. Malicious actors can exploit vulnerabilities in users’ mobile devices or operating systems, such as by rooting or jailbreaking a device, installing malware, or exploiting system-level vulnerabilities. Since developers can protect their applications but not users’ devices, they have little power over what’s happening on a device. However, developers can still take some actions to protect this attack vector, including implementing device fingerprinting and anomaly detection techniques to identify and flag potential device-based threats.

As you can see, there are many emerging threats for mobile banking apps and their users. This is why it’s critical to ensure mobile banking application security in order to safeguard sensitive user data and prevent cyber threats. In the next section, we explore best practices for boosting the security posture of your mobile banking app.

Read also

Building a Transparent Encryption Framework to Secure Android Applications: A Step-by-Step Guide

Check out how you can make sure your data stays protected even on rooted devices with the help of transparent encryption.

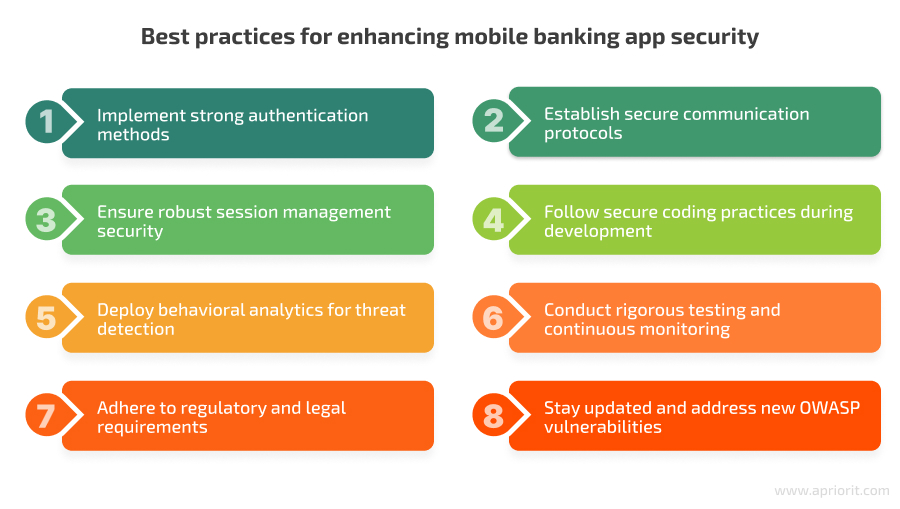

8 best practices for enhancing mobile banking app security

Based on our experience with mobile banking app security, we can outline eight best practices for developers to implement robust security measures. By following them, you can significantly improve the resilience of your mobile banking app, promote a safer digital banking experience for your users, and reinforce trust in your application and its ability to protect sensitive financial information.

Keep in mind that these practices are universal and taken from our personal experience. While they can significantly boost the security of your mobile banking app, you still need to take into account other factors, such as the technical characteristics of your application and local regulatory requirements.

Let’s take a look at each of these practices in detail.

1. Implement strong authentication methods

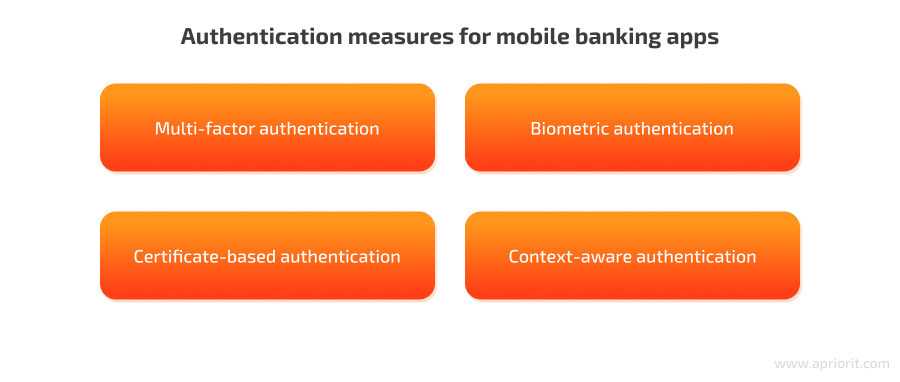

As mentioned before, authentication is the first line of defense against unauthorized access and other cyber threats to your mobile banking app. Authentication verifies the identity of users attempting to access sensitive financial information. With the help of authentication, you can allow authorized individuals access and keep malicious actors away.

Using a multifaceted approach to authentication boosts your app’s security posture from the get-go and mitigates the risks of mobile banking apps connected to unauthorized access and data breaches. To enhance the security of your mobile banking app, start with implementing robust authentication measures:

Multi-factor authentication (MFA). MFA adds an extra layer of security by requiring multiple authentication factors, such as a complex password, biometrics, and a one-time password (OTP) to verify a user’s identity. It goes beyond traditional password-based authentication by implementing additional layers of verification. Usually, MFA includes one more layer in addition to a password to create two-factor authentication. For example, in addition to a password, a user may be asked to:

- Provide an OTP sent to the user’s mobile device

- Answer a voice call to a registered phone number

- Provide a physical hardware token that generate a unique code

MFA significantly increases the difficulty for cybercriminals to gain unauthorized access, even if they have compromised a user’s password.

Biometric authentication. This additional layer of security might include fingerprint or facial recognition. Biometric authentication verifies a user’s identity based on their unique biological characteristics. It is considered more secure than traditional password-based methods, as it is more difficult to forge or replicate biometric data.

Certificate-based authentication. You can use digital certificates stored on users’ devices or smart cards for authentication purposes. These certificates contain cryptographic keys that authenticate a user’s identity. Both the mobile banking app and the server can present their own digital certificates to each other. These certificates verify the identities of both parties involved in the communication, preventing unauthorized actors from impersonating either side.

Context-aware authentication. Context-aware authentication goes beyond traditional static verification methods and adapts security measures to the specific context of a user’s interaction with the mobile banking app. With this approach, you can provide a more secure and convenient user experience by balancing security with frictionless access. This method considers high-risk locations, trusted zones, unusual login times, rapid login attempts, jailbroken or rooted devices, and other factors.

2. Establish secure communication protocols

Protecting data transmitted between the user’s device and the app’s servers is essential for preventing interception and theft of sensitive financial information. By implementing secure communication protocols and end-to-end encryption, you can make sure that data remains protected throughout its journey.

End-to-end encryption (E2EE) encrypts data at its source and decrypts it as soon as it reaches its intended destination. This means that data remains encrypted throughout its journey, and only authorized parties possessing the decryption keys can access and decipher it. Even if a hacker gains access to the network or compromises the app’s servers, the encrypted data remains indecipherable and unusable without the decryption keys.

Encryption protocols create secure communication channels between users’ devices and the app’s servers. Commonly used encryption protocols such as Transport Layer Security (TLS) and Advanced Encryption Standard (AES) are crucial for encrypting data packets, protecting them from interception, eavesdropping, and tampering during transit.

- TLS encrypts data exchanged between devices and servers, securing it against unauthorized access and ensuring data integrity.

- AES is a symmetric encryption algorithm that encodes information in a format that is only decipherable with the appropriate decryption key.

Together, secure communication protocols and EE2E create a strong barrier against unauthorized access and data breaches.

3. Ensure robust session management security

Managing user sessions could prevent unauthorized access to your mobile banking app and maintain the integrity of user interactions with the app. Session hijacking is among the most common threats with regard to session management. When a session is active, a user can navigate the app, conduct transactions, and manage their finances. Attackers can exploit many weaknesses in software to gain unauthorized access to an active session, steal the session ID, eavesdrop on a user’s activities, or even manipulate transactions.

Automatic session timeouts can terminate user sessions after some period of inactivity. Users can specify when sessions should be terminated due to inactivity in the app.

Device-specific access limits access to user accounts from authorized devices. For this, you need to implement device registration and verification to reduce the risk of unauthorized access even if a user’s login credentials are compromised.

4. Follow secure coding practices during development

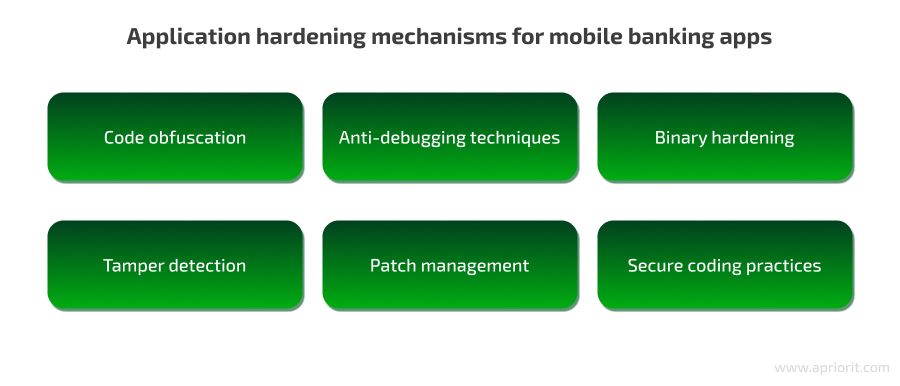

These include techniques and practices that strengthen the security posture of software applications, making them more resilient against attacks and exploitation. They fortify the defenses of the mobile banking app in general, preventing attacks on critical code and sensitive data and deterring code tampering by malicious actors.

Code obfuscation. With the help of this technique, you can alter the application’s source code to make it more challenging for attackers to understand. Code obfuscation includes methods like renaming variables, obscuring the control flow, inserting dummy code, and encrypting strings, making it complex and convoluted for attackers to decipher the original logic.

Anti-debugging techniques. Attackers often rely on debuggers to dissect app behavior and exploit flaws. Anti-debugging mechanisms are designed to detect and deter attempts by attackers to debug the application. They involve implementing code that detects debugging tools and techniques, causing the application to behave differently or terminate to prevent analysis.

Binary hardening. This involves applying security measures at the binary level of the application, making the app resistant to memory exploits and manipulation. It includes techniques like address space layout randomization, data execution prevention, control flow integrity, and stack canarying. Binary hardening can protect your banking app against buffer overflows, memory corruption, and other common mobile banking vulnerabilities.

Tamper detection. With the help of this technique, you can detect unauthorized modifications or tampering attempts on the application or its code. Tamper detection functionality triggers alerts or even takes preventive measures by itself.

Patch management. After the release, it’s essential to regularly update and patch the application to address known vulnerabilities and weaknesses. For example, with automated patch deployment, you can streamline the process of updating devices and minimize the window for exploitation.

Secure coding practices. You need to follow secure coding standards and best practices during the development phase. This helps you mitigate vulnerabilities from the very beginning, reducing the likelihood of exploitation. Examples of secure coding practices include input validation, proper error handling, and secure memory management.

Related project

Developing a Custom MDM Solution with Enhanced Data Security

Explore how creating a custom MDM solution with enhanced data security enabled our client to manage all connected tablets within one system.

5. Deploy behavioral analytics for threat detection

With the help of behavioral analytics, you can actively monitor user behavior patterns, find anomalies in users’ activities, and prevent fraudulent actions. This can help you identify potential fraudulent activity, such as unauthorized access attempts or unusual spending patterns, even before any financial damage occurs. For example, behavioral biometrics can analyze a user’s typing patterns, swipe gestures, or even voice characteristics during login to detect potential impersonation attempts. Other behavioral patterns might include transaction and app interaction patterns.

Here are some techniques for effectively implementing behavioral analytics into mobile banking app development:

- Event logging, which captures user actions like login attempts, transactions, screen navigation, time spent on specific features, and device information

- Rule-based anomaly detection, which uses rules based on known fraudulent patterns, such as large transactions from unfamiliar locations or rapid login attempts from different devices

- Trigger alerts, which are governed by risk-scoring models based on potential severity and impact

You can leverage machine learning algorithms in your secure mobile banking app to constantly analyze vast amounts of user data and transactional behaviors. These algorithms learn and adapt over time, so they can detect more and more threats and boost the accuracy and effectiveness of fraud detection systems.

Related project

Building AWS-based Blockchain Infrastructure for International Banking

Explore how our client got secure, scalable, and efficient AWS infrastructure for their future blockchain-based FinTech project.

6. Conduct rigorous testing and continuous monitoring

Testing and monitoring are critical elements in boosting the security of mobile banking apps after their release. Here are the main components of these security measures, which include a range of proactive measures:

Regular security audits. Conducting routine security audits of your mobile banking app includes assessing and evaluating the application’s security infrastructure, codebase, and configurations. You can perform security audits yourself or hire external security experts with expertise to identify vulnerabilities, compliance gaps, and potential risks. As a result of security audits, you can pinpoint weaknesses and take proactive measures to mitigate them.

Penetration testing. With the help of penetration testing, you can simulate attacks on a mobile banking app to uncover exploitable vulnerabilities. Skilled security professionals mimic techniques used by real attackers to infiltrate an application’s defenses. By simulating SQL injection, cross-site scripting, and other common attack vectors, you can expose vulnerabilities that could potentially be exploited by malicious actors.

Continuous threat monitoring. You can deploy various monitoring tools and systems that operate around the clock, actively scanning for anomalous activities, unauthorized access attempts, and potential security breaches. As soon as any suspicious activity is detected, you will receive an immediate alert and an automated response for threat mitigation.

7. Adhere to regulatory and legal requirements

Mobile banking applications operate within a regulatory framework that creates specific standards for data protection for mobile banking apps, user privacy, and security. You need to make sure that your app complies with these regulations to uphold the highest security standards and protect user privacy. Here are some of the most fundamental legal requirements for mobile banking apps:

- Payment Card Industry Data Security Standard (PCI DSS): Mobile banking apps that handle payment card information must adhere to PCI DSS standards, which ensure secure cardholder data storage, transmission, and processing.

- General Data Protection Regulation (GDPR): Apps operating in regions under GDPR jurisdiction must prioritize user consent, data minimization, encryption, and transparent data handling practices to protect users’ privacy rights.

Following these regulations is not only beneficial for legal compliance. It also boosts the overall security posture of your mobile banking app, as they mandate robust security protocols, encryption standards, access controls, incident response procedures, and data protection mechanisms.

8. Stay updated and address new OWASP vulnerabilities

The Open Web Application Security Project (OWASP) regularly identifies and publishes a list of the most critical security risks facing software applications. In their top 10 list, they outline the most critical security risks to web applications, including mobile banking apps. For this reason, your development team needs to track and address new vulnerabilities to adjust their security measures accordingly. Here are some of the new vulnerabilities in the 2023 OWASP list:

- M1: Improper Credential Usage

- M2: Inadequate Supply Chain Security

- M4: Insufficient Input/Output Validation

- M6: Inadequate Privacy Controls

By proactively addressing new OWASP vulnerabilities, you can reinforce the security of your mobile app and stay ahead of evolving threats.

Read also

OWASP Mobile Top 10 Risks and How to Address Them

Learn more about the most prevalent vulnerabilities for mobile platforms according to OWASP.

How can Apriorit help you strengthen the security of your mobile banking app?

Apriorit can help you with improving your existing mobile banking app or with developing a new application from scratch. We take into account all FinTech industry requirements, as well as your local regulations. Our team of cybersecurity experts has extensive experience in developing and implementing secure solutions for a wide range of industries, including finance. We use our deep understanding of the latest cybersecurity threats and trends to help our clients develop and implement robust security measures. We can assist you with:

- Designing a secure architecture for your new mobile banking app

- Adding new features to your existing application

- Implementing security best practices during the development process

- Conducting mobile banking app security testing for vulnerabilities and fixing them before it’s released

If needed, we can provide ongoing support and address newly emerging threats.

Together, we can create an application that is not only convenient but also secure for your users. We will empower your customers to use your app with confidence, knowing that their money and sensitive data are protected.

Conclusion

Mobile banking apps have become more than just tools for checking balances or making payments. A mobile banking app contains lots of private and financial information, so protecting your mobile banking app from malicious actors should be the highest priority during development. To maximize protection against security vulnerabilities, you need to work with experts who can implement best practices and fine-tune them to your product’s specific needs.

Whether you need to create an application from scratch or improve the security of an existing application, you should make it a priority to protect your mobile banking app from vulnerabilities during the development stage. Our mobile software development and security testing teams will work together to achieve the highest level of security for your application.

Want to build a reliable mobile banking application?

Start your project’s journey today with Apriorit. Our team is ready to design and deliver a secure system tailored to your unique needs.