Background

The microfinance company CreditKasa was looking for a development partner to prepare a complete set of documentation, including detailed functional and technical specifications, to guide their lending mobile app development project.

The new mobile application would be based on the company’s existing web platform, and the documentation had to outline how the app would replicate key features of the existing platform while ensuring robust data security tailored to mobile environments.

To achieve this, CreditKasa partnered with Apriorit to carry out a comprehensive discovery phase.

The client

CreditKasa is one of the biggest microfinance businesses in Ukraine. They provide fast and accessible online lending solutions to individuals across the country.

| Our client: | CreditKasa |

| Location: | Ukraine |

| Industry: | FinTech, Microfinance |

| Collaboration with Apriorit: | Long-term and ongoing |

| Services we provide: | – Project discovery • Requirements elicitation • Business analysis • Documentation development • Architecture creation |

| Deliverables | – Product vision document – Functional specification – Technical documentation (API mapping, security guide, system architecture) – Project plan (Gantt chart, team composition) – Analytics vision document – Analytics event specification |

The challenge

CreditKasa wanted to develop a money lending mobile app that was similar to their existing web platform but would make loan services more accessible and convenient for users. The new product had to retain all key features of the website while offering a smooth experience optimized for mobile devices.

In addition, the mobile application was expected to enhance customer support by enabling direct in-app communication. From the business perspective, this new channel would also extend opportunities for collecting behavioral analytics and running personalized promotional campaigns through targeted push notifications, helping the company both strengthen user engagement and generate additional revenue.

To make all this possible, the client needed comprehensive documentation for developing the mobile app they envisioned. They decided to rely on an experienced external team to conduct a mobile app discovery phase, define the app’s architecture, and ensure a solid technical foundation.

During the discovery phase, Apriorit was tasked with:

- Analyzing the existing web solution and its complex user verification flow

- Defining the full scope and vision for the mobile application

- Preparing detailed functional and technical specifications for development and third-party integrations, such as payment processors and KYC services

- Ensuring compliance with regulatory standards of the National Bank of Ukraine and providing security recommendations

- Planning seamless integration with the client’s CRM and backend systems

The result

As a result of the discovery phase, we provided our client with a complete and structured vision of how the new mobile product should look and function. Deliverables included:

- A full set of documentation covering all internal and external user interaction processes

- A detailed implementation plan

- A recommended technology stack

- Guidance on the optimal team composition for lending mobile app development

- Extensive recommendations on making the app secure and compliant with regulations

Related project

Evaluating Smart Contract Security for Decentralized Finance (DeFi)

Explore how Apriorit performed an in-depth smart contract audit and provided recommendations on contract mitigation to ensure flawless security and help our client maintain a reputation for reliability and customer trust.

How we did it

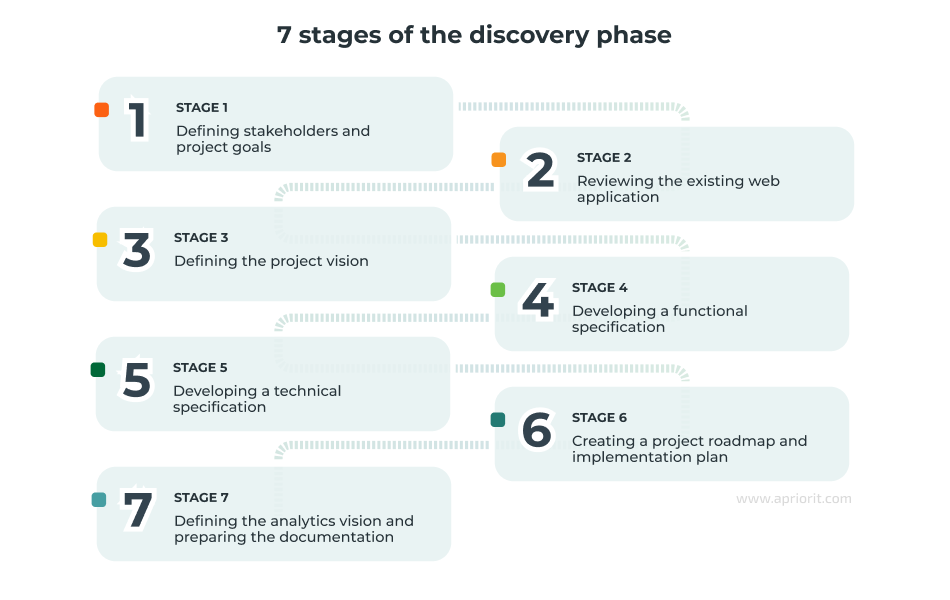

Stage 1. Defining stakeholders and project goals

Our work began with identifying key stakeholders and defining the overall scope of the project.

The client introduced us to their existing credit service website and explained their goal — to create a mobile application that would replicate core website functionality while offering a mobile-optimized experience.

We also defined the app’s extended business objectives, target audience, and success criteria. The mobile solution needed to enable new capabilities such as in-app support tools and targeted push notifications for personalized offers and communications. These additions were aimed at helping the company enhance customer engagement and open up new revenue opportunities.

Stage 2. Reviewing the existing web application

Next, our team conducted an in-depth analysis of the client’s existing web platform.

The product’s credit flow was highly branched, with multiple verification stages that varied depending on the user’s credit history. To fully understand all possible user paths, we held a series of interviews with representatives of the client’s technical, marketing, support, and security departments.

This research helped us document the platform’s logic, dependencies, and constraints, as well as identify areas that could be streamlined or optimized in the mobile version.

Stage 3. Defining the project vision

Once we had a full understanding of the system, we prepared a high-level vision document that outlined the app’s structure and functionality. It included:

- A comprehensive list of features

- All planned integrations

- Security mechanisms such as biometric authentication, KYC services, and live detection tools

The vision document was reviewed by all stakeholders, including the client’s cybersecurity specialist, to ensure that every feature aligned with regulatory requirements and internal security policies. After final approval, the vision became the foundation for the next stage — creating the functional specification.

Stage 4. Developing a functional specification

At this stage, we detailed each feature and user flow and transformed all of them into user stories with acceptance criteria. We paid particular attention to compliance with the National Bank of Ukraine’s regulations, which imposed strict requirements on data verification and user identification flows.

To build a comprehensive functional specification, we:

- Identified user journeys, core features, and system interactions

- Outlined functional and non-functional requirements

- Defined technical constraints, including supported iOS and Android operating system versions and platform limitations

Our business analyst also collaborated closely with the client’s designer to ensure that the UI design remained consistent with the website while adapting naturally to mobile devices.

After the design was approved, we updated both the functional and technical specifications so that the documentation fully matched the design and reflected all current requirements.

Stage 5. Developing a technical specification

Based on the approved functional requirements, we created a complete technical specification that described the app’s architecture, data flow, and integrations. The client’s ecosystem included a large and complex CRM with hundreds of API endpoints, so smooth integration was a key priority.

Our team researched and validated multiple third-party services for KYC verification, biometric identification, and payment processing to ensure a secure and seamless user experience.

We selected and validated several third-party services to ensure secure and seamless user verification and payments:

- BankID — allowed users to securely verify their identity using official banking credentials

- FaceTec SDK — added live facial recognition and liveness detection to prevent fraud during onboarding

- Fingerprint SDK — supported biometric login and identity verification directly from users’ devices for greater convenience and security

- Payment merchant modules — enabled safe transaction processing and ensured full compliance with financial data protection standards

Throughout this stage, security remained our top priority. We defined best practices for encryption, secure authentication, and data protection, ensuring the mobile app would meet strict requirements of the FinTech and microfinance domains.

As a result, we delivered a technical specification document that included:

- API mapping and backend dependencies

- A plan for integrating with external services (FaceTec SDK, Fingerprint SDK, BankID, payment merchant modules)

- Mobile app technical requirements

- Application security guide

- System architecture overview

Stage 6. Creating a project roadmap and implementation plan

With all specifications approved, we developed a project roadmap outlining the implementation plan, team composition, and development sequence.

This plan provided the client’s internal team with a structured approach for executing the project and clear visibility into the required expertise at each stage.

The deliverable at this stage was a Gantt chart that included:

- A proposed development plan

- Team roles

- Steps for implementing the mobile application

Stage 7. Defining the analytics vision and preparing the documentation

Once the main documentation was complete, the client requested an additional discovery stage focused on analytics. They wanted to understand user behavior throughout the credit flow, identify points of friction, and optimize the conversion rate.

We created an analytics vision document detailing goals, KPIs, and the flow of data between tools such as Google Analytics, Firebase, AppsFlyer, and the client’s CRM. This specification also defined event tracking, user segmentation logic, and methods for calculating customer lifetime value (LTV).

As a result, we delivered two more documents:

- An analytics vision document that included:

- Business goals and KPIs (user behavior, drop-off points, conversion tracking)

- Selected tools (Google Analytics, Firebase, AppsFlyer, CRM integration)

- User identification and event tracking logic

- Data flow diagrams

- A user behavior tracking plan with detailed data mapping and event tracking from each analytics tool

Then we finalized and unified the documentation.

The impact

By partnering with our team, the client gained access to deep expertise in mobile development, behavioral analytics, and data security — all of which were reflected in the documentation delivered during the discovery phase.

Armed with a clear product vision and a solid technical foundation, the client can now confidently move forward with developing a mobile app to expand their business and strengthen their market presence.

Once implemented, the mobile app is expected to open an additional revenue stream and reduce marketing costs through the use of targeted push notifications and user segmentation features.

Turn your vision into a development-ready blueprint

Get clear specifications, architecture and documentation that set your project up for success with Apriorit.