Imagine getting a fair car insurance rate or having your insurance claim settled in just a couple of minutes. With many of today’s insurance companies still relying on manual processing of paper documents, this sounds like a dream. Artificial intelligence (AI) holds the potential to make this dream a reality.

According to McKinsey & Company, AI-enabled automation will replace more than half of all claims processing activities by 2030. Yet when it comes to adopting AI for a more specific task — like providing vehicle insurance services — businesses face a number of challenging questions.

In this article, we discuss the key reasons for implementing AI in the auto insurance field. We analyze how AI helps auto insurers by overviewing four main car insurance tasks that you can complete with the help of AI technologies and the challenges you might need to overcome when doing so. This article will be useful for teams planning to enhance an existing product with AI capabilities or build new AI-based solutions for car insurance.

Contents:

The need for AI-powered car insurance solutions

Car insurers strongly rely on different kinds of software in their daily workflows. They need to validate, process, analyze, manage, and store huge amounts of data generated by different parties:

- Insurance providers

- Car manufacturers and service providers

- Third-party contractors

- Customers

As cars on the roads grow in their number and variety, insurers have to adjust their premium calculations accordingly. Just a few decades ago, insurance calculations relied on vehicle size classes, distinguishing cars by their weight and engine size. Today, insurance quotes must also take into account the type of energy source, the levels of vehicle computerization and autonomy, and other parameters.

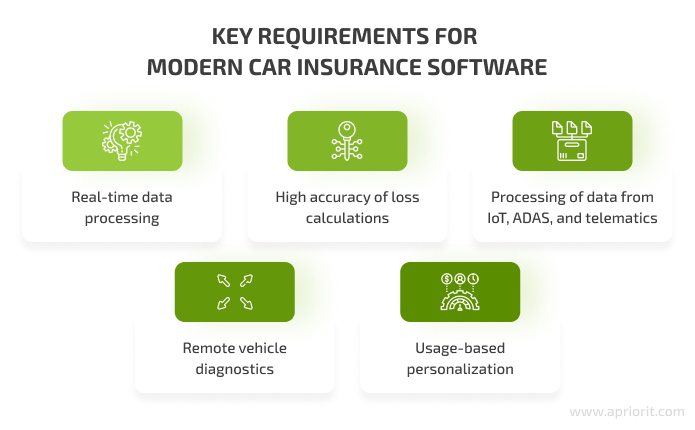

Car insurers also have several operational needs that legacy software can’t fully cover:

- Process data in real time — Whether calculating a quote or providing customer assistance, it’s critical for an insurance solution to be able to quickly process input data from different sources and provide accurate results.

- Increase the accuracy of calculations — Cost estimates for car repairs, medical services, and claims processing expenses form the basis of insurance premium cost calculations. Inaccurate and delayed estimates may turn away potential customers or lead to significant financial losses for the insurer.

- Serve connected cars — Today’s roads are filled with vehicles equipped with IoT sensors, telematics, and advanced driver-assistance systems (ADASs). All these technologies gather and generate tons of useful data like geometric data, vehicle state parameters, and driver behavior data. Yet not all vehicle insurance solutions can properly handle these types of data — and the quantity of data generated.

- Provide remote car diagnostic services — Due to the pandemic, many countries have encouraged shifting to digital delivery of insurance services. However, not all legacy auto insurance solutions allow for the adoption of virtual estimation and inspection methods.

- Offer usage-based service personalization — To let their customers “pay how they drive,” auto insurance companies need a solution that can continuously monitor and analyze driver behavior.

To learn more about possible use cases, check out our article on using machine learning in automotive industry.

Outsource routine insurance activities to advanced AI algorithms!

Enhance your auto insurance software with rich task automation capabilities. Let Apriorit’s team build you a reliable and secure custom AI module.

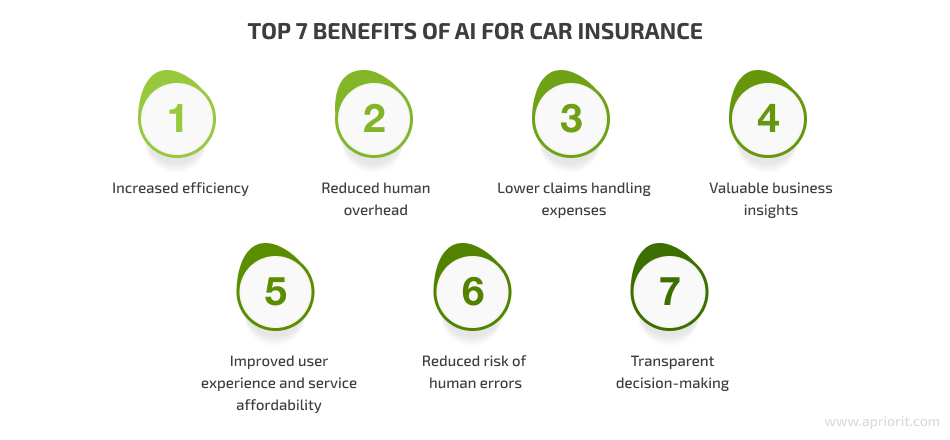

Artificial intelligence technologies can be the key to addressing these challenges. Enhancing car insurance solutions with AI holds the potential for:

- Increased efficiency — An AI system enables real-time data collection and processing, enabling insurance companies to speed up activities like underwriting, claims processing, and appeals processing.

- Reduced employee overhead — Automated processing of customer claims and requests enables insurance company employees to focus on more complex tasks and cases.

- Lower claims handling expenses — Automation of routine activities and communications also leads to reduced costs per claim.

- Valuable business insights — While processing unstructured data, an AI can find unobvious patterns and extract valuable insights that help insurers improve operational processes and make better business decisions.

- Improved user experience and service affordability — With an ongoing AI-powered analysis of driver behavior and a vehicle’s state, insurers can deliver more affordable and personalized services to their customers.

- Reduced risk of human errors — Whereas humans may accidentally misclassify a claim or apply the wrong decision, AI-powered automation may help you mitigate this risk.

- Transparent decision-making — AI-based automation can also help address customer concerns about discrimination and unfair policy calculations. Relying on a clear set of parameters, an AI system can make applied pricing policies, repair costs, and claims processing outcomes easier to justify.

Deploying AI-based solutions may help insurance companies lower expense ratios, improve claims management, and enhance the customer experience. However, the efficiency of AI-powered tools can vary depending on the task you apply them for. In the next section, we overview some AI use cases for auto insurance and outline processes that can benefit from AI.

Top 4 vehicle insurance tasks to solve with AI

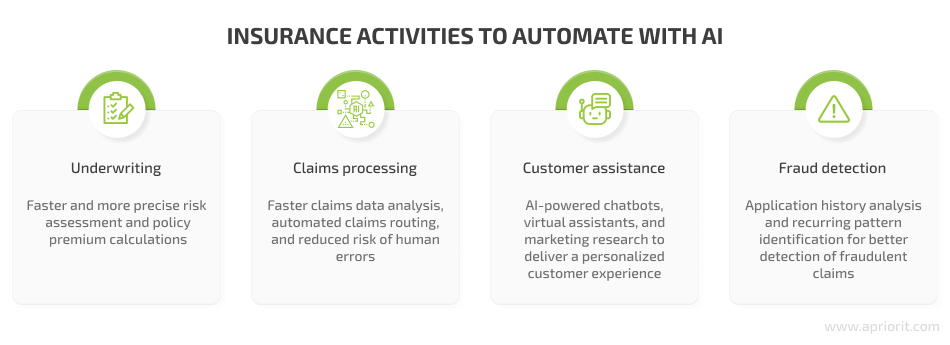

AI technologies can bring outstanding data processing capabilities to the insurance industry, enabling insurers to automate some of their key tasks:

So how do auto insurance companies use AI?

When it comes to artificial intelligence in auto insurance, the list of potential AI applications goes far beyond simple task automation. Implementing AI and machine learning (ML) technologies, car insurers can expand the range of delivered services and significantly improve the customer experience. Let’s take a look at some of the key vehicle insurance tasks that would benefit from AI adoption:

Related project

Leveraging NLP in Medicine with Custom Model for Scientific Reports Analysis

Explore how our AI-powered NLP integration enabled a medical research client to extract critical information from clinical text, accelerating their scientific research process. This software allows their analysts to concentrate on more complex tasks and improve diagnosis accuracy.

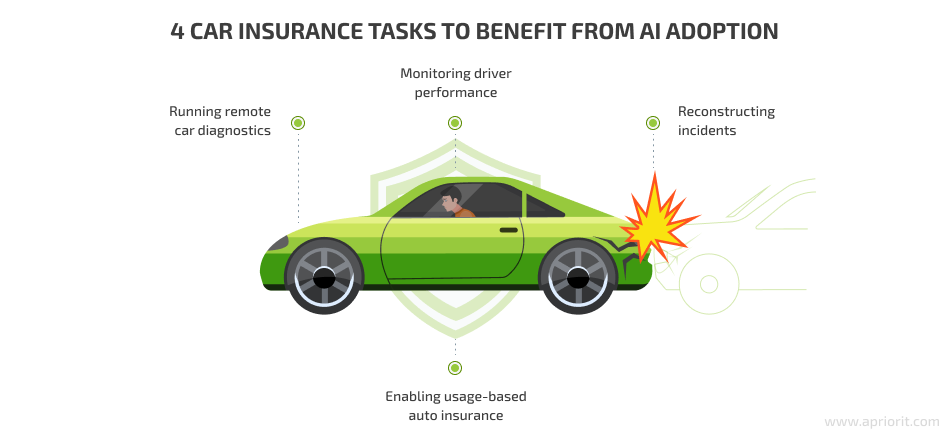

Enabling usage-based auto insurance

Usage-based insurance (UBI) is a relatively new approach to personalized quotes that may soon become a new golden standard for vehicle insurers. In contrast to traditional insurance, UBI relies on current behavior patterns rather than retrospective data.

There are two types of usage-based auto insurance:

- Pay-as-you-drive — The policy cost depends on either the time or the distance driven during a specified period. Mileage is logged automatically using telematics technology, usually with the help of onboard devices.

- Pay-how-you-drive — The cost for insurance is continuously adjusted based on the driving patterns of a particular customer: the safer their driving, the lower the insurance price. Common criteria taken into account for policy price calculations include speed and braking patterns, the traffic environment, and the number of miles driven.

A Columbus-based project called Root is one of the few insurers that already estimate the price of their premiums based on the pay-how-you-drive model.

Monitoring driver performance

AI systems can continuously monitor a driver’s behavior, traffic conditions, and data from in-car sensors. Based on analysis of this data, the system can detect the risk of a road accident faster than a driver and alert the driver about it. Also, monitoring data can be used to assist drivers in improving their driving skills and developing safer driving habits.

For example, the Nauto project uses an AI system to analyze data from in-car sensors and alert drivers of potential collisions before they occur.

Car insurers can also benefit from deploying an AI-powered driver monitoring system to educate new drivers and reduce the overall risk of collisions on the road.

Running remote car diagnostics

Using AI technologies, car insurers can enable remote delivery of one of their key services — car diagnostics. During the COVID-19 pandemic, many businesses were forced to readjust their service delivery models. Motor vehicle insurers also had to come up with a way to provide their services remotely, without direct human contact.

With an AI-powered diagnostics system, car insurers can gather and process real-time data from in-car sensors to better evaluate a vehicle’s condition. They can also apply AI technologies to evaluate car damage based on video and photo materials received from in-car or external cameras.

For instance, USAA relies on an AI-based cloud platform to assess car damage based on photos. Tractable leverages AI technologies to enable remote vehicle inspections based on videos made with a smartphone.

Reconstructing incidents

Another promising possibility is to use AI for car accident claims, particularly to recreate the details of a car accident based on dash camera footage and in-car sensor data. While doing so, you can also rely on artificial intelligence to detect auto insurance fraud. Having a precise, AI-generated timeline of an accident speeds up accident investigation and claims processing while reducing the risk of fraudulent claims.

The Israel-based Nexar project has recently teamed up with a Japanese insurance company to implement their AI-powered car crash reconstruction system into 200,000 vehicles.

While holding promising potential, AI technologies can be challenging to implement. In the next section, we discuss some of the key challenges to take into account before starting your journey into the AI world.

Read also

Artificial Intelligence for Image Processing: Methods, Techniques, and Tools

Uncover the capabilities of AI in digital image processing for online services and mobile apps. Explore the top neural network models and tools to start building applications that effectively process and analyze digital images.

5 preparatory steps for moving to AI-based car insurance

No matter the field, adopting AI is a complex process that requires thorough planning and preparation. When working on a car insurance solution enhanced with AI capabilities, the key questions to think about in advance are:

Answering each of these questions can help you take one step closer towards enhancing your vehicle insurance product with AI capabilities.

1. What tasks will I apply AI for?

Not all tasks that can be performed with the help of AI and ML indeed require these technologies. In some cases, traditional rule-based automation may deliver just the same outcomes as an AI system while being less resource-hungry in terms of development and maintenance.

The best choice would be to apply artificial intelligence for car insurance tasks when it comes to processing huge amounts of real-time data. For example, processing and tons of insurance claims and detecting fraud is one of the key LLM use cases.

AI technologies can also help you deliver outstanding service personalization, as no human can quickly and efficiently analyze as much data as an AI system. Additionally, AI is known for its ability to extract valuable insights from unstructured data, laying the ground for even better service personalization.

2. How will I implement AI capabilities in my service?

You might need to take a different approach towards AI implementation in auto insurance

depending on whether you already have a car insurance solution or are only planning to build one.

When building a new project from scratch, you can plan its entire architecture with the AI system’s requirements in mind to achieve maximum efficiency. However, if you have an existing solution that you want to enhance with AI capabilities, it’s better to make compatibility and stability your priorities.

As for the development itself, you can always try to save both time and budget by looking for a fitting AI API. Even if it’s not a 100% match, it still might be easier to customize an existing AI system than to build and test a new one.

Read also

Biased Artificial Intelligence: Can Your AI Solution Be Freed from Built-in Prejudice?

Explore the phenomenon of AI bias, its causes, and its effects on your projects. Discover the practical steps to reduce bias and ensure fairness in your AI-based solutions.

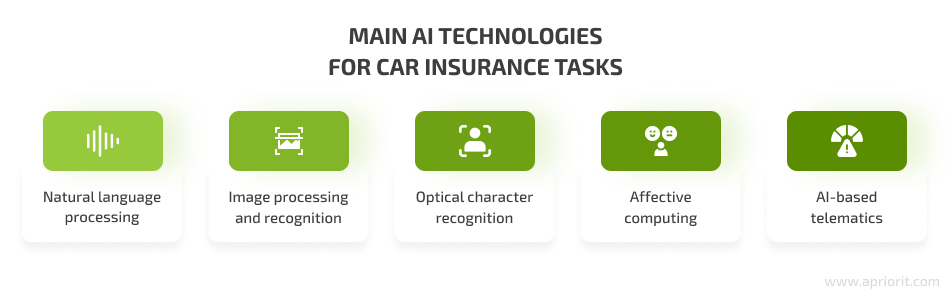

3. What technologies should I choose?

Your choice of technology stack will fully depend on the range of tasks you want to perform using AI. Below, we outline some of the key ways you can leverage different AI and ML technologies within car insurance products:

- Natural language processing (NLP) technologies are key to implementing AI-based chatbots and virtual assistants as well as to speeding up claims processing.

- Image processing and recognition techniques enable remote car diagnostics and improve the quality of car damage evaluations. You can rely on these techniques for both the initial evaluation of a vehicle at the underwriting stage and for post-accident assessments.

- Optical character recognition (OCR) or simply text recognition can help you save time on digitizing handwritten documents and processing document scans.

- Affective computing, otherwise known as emotional AI, can process and identify human emotions, bringing further improvements to driver behavior monitoring and fraud detection.

- AI-based telematics offer higher precision of risk assessments and enable predictive driver alerts by continuously processing and analyzing data on a vehicle’s speed, acceleration, braking, cornering, and other meaningful factors.

4. Where can I get enough quality data?

No AI system can perform efficiently without enough quality data. Therefore, you need to think ahead about the kinds of data your solution needs and where to get it.

For instance, one of the most difficult and resource-consuming car insurance tasks is evaluating vehicle damage. The evaluator has to take into account multiple factors: the vehicle’s model, age, mileage, and previous damage as well as the cost for repairs. And to move all these calculations to an AI system, you first need to train that system on the right data.

Once you determine what sort of data you need, you can start looking for ready datasets and pre-trained AI systems that you can customize for your needs. For example, the Cogito project provides labeled image datasets for car insurance.

You can also try improving the quality of available datasets using data augmentation techniques.

5. What challenges can I expect along the way?

Getting enough quality data isn’t the only challenge you should expect when using AI in car insurance. Here are some other pitfalls to be aware of:

- Acquiring relevant technical skills — Building and testing an AI system is a technically challenging process that requires a high level of expertise in the application of specific technologies, tools, and approaches. You can close the gap in technical skills by outsourcing product development to a dedicated team or by augmenting your internal team with the needed professionals.

- Ensuring data security — Car insurance solutions work closely with sensitive and confidential information. Your AI system should guarantee the security of any data it processes. Data encryption and data anonymization techniques can help you tackle this challenge.

- Reducing bias — AI systems can inherit bias from different sources, including datasets and algorithms. This is especially relevant for solutions that make decisions based on personal data. To increase the fairness of your solution, consider cross-checking your algorithms and applying different datasets during model training.

Conclusion

AI adoption can bring significant improvements to car insurance solutions. It can automate and speed up routine tasks, mitigate the risk of human errors, and increase the personalization of services. But to get the best result possible, it’s vital to apply the right AI technologies for the right tasks. Such challenges as a lack of relevant high-quality data and technical skills as well as data security concerns should also be taken into account.

Apriorit’s team of AI experts will gladly assist you in building a new AI system or help you enhance your existing solution with AI capabilities. We can also help you determine whether your project even needs AI functionality and provide advice on possible AI alternatives. Get in touch with us to start discussing AI adoption options for your project.

Let’s build a cutting-edge AI system for your auto insurance business

Leverage Apriorit’s experience delivering top-notch artificial intelligence and machine learning products to get an AI-based solution that fits the requirements of your business and end users.