Key takeaways:

- Modern fraud tactics are evolving and becoming more nuanced with the use of GenAI, cryptocurrencies, and cloud networking.

- Banks’ fraud detection systems must rapidly evolve to secure customers’ data and finances.

- Machine learning can augment or substitute traditional rule-based detection as it can pick up nuanced, hidden, and complex fraud attempts.

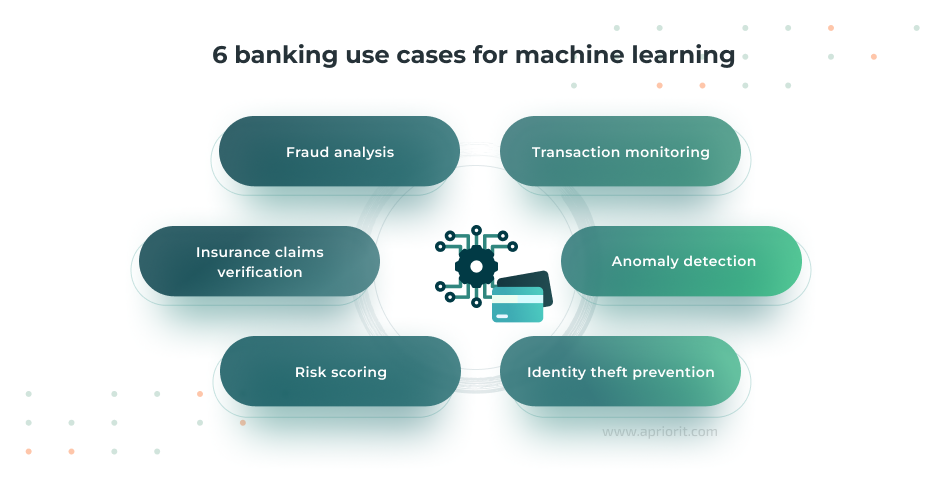

- Banks can use machine learning for fraud detection in banking transaction monitoring, risk scoring, anomaly detection, identity theft prevention, and many other tasks.

- When building an efficient ML-based detection solution, you must ensure legal compliance, keep your model unbiased and interpretable, prevent false positive results, and prepare scalable infrastructure for data exchange.

Cybersecurity professionals are worried about the industrialization of fraud, its growing complexity, and malicious use of cutting-edge technologies and virtually unlimited computing resources. And since most malicious actors target financial data, banking organizations are among the first who need to enhance their cybersecurity.

Catching new, nuanced threats with manual or rule-based cybersecurity tools is nearly impossible. Machine learning (ML) helps banks detect and stop complicated and unusual fraud attempts. In this article, we examine how it works, how machine learning-based systems differ from rule-based ones, and how to implement ML algorithms in a banking environment.

This article will be useful for cybersecurity specialists and banking leaders who are looking for ways to improve fraud detection in banking.

Contents:

- Why use machine learning to detect fraud?

- Rule-based vs ML-based fraud detection

- How ML helps in detecting bank fraud

- Types of ML algorithms to use for fraud detection

- Challenges of implementing ML-based fraud detection: Apriorit’s approach

- 1. Issues with training data

- 2. Complex data infrastructure

- 3. Poor cybersecurity of the model

- 4. Poor model interpretability

- 5. Unclear and false positive results

- 6. ML bias

- How can Apriorit help you implement ML-based fraud detection?

- Conclusion

Why use machine learning to detect fraud?

As cutting-edge technologies become easier to access, malicious actors are using them to carry out more complex and realistic hacking and fraud attempts — and to mask them as legitimate activities. For example, malicious actors actively use artificial intelligence (AI) and generative AI (GenAI) tools to create synthetic identities and fake documents that are hard to distinguish from real ones.

A financial firm in Hong Kong lost $25 million after an employee received a deepfake of their boss instructing them to transfer money. And the threat of AI-powered fraud will only become more damaging in the future: Deloitte’s Center for Financial Services predicts that GenAI could facilitate fraud losses reaching $40 billion in the US by 2027.

Apart from AI, malicious actors also heavily rely on cryptocurrencies to anonymize transactions and launder money, Infrastructure as a Service to deploy temporary remote environments, and data analytics to prepare information for a successful attack. Traditional rule-based detection systems can’t catch such sophisticated threats, which is why banks are turning to machine learning for fraud detection.

It’s important to distinguish machine learning from artificial intelligence, which is a broader technology that provides machines with the ability to perform tasks that typically require human intelligence for reasoning, problem-solving, and decision-making.

Machine learning is a subset of artificial intelligence (AI) that enables software to learn from data and improve its performance on specific tasks through experience. Instead of being explicitly programmed with rules, a machine learning system uses models that analyze large datasets and identify patterns to predict future behavior. For example, an ML system can learn what normal customer transactions look like and then spot unusual activity that may suggest fraud.

While AI can include rule-based systems, expert systems, and symbolic reasoning, machine learning specifically relies on data-driven algorithms that learn and adapt over time.

With this in mind, let’s see how traditional rule-based system compares to machine learning in fraud detection.

Enhance your banking cybersecurity with cutting-edge technologies

Apriorit’s team is always at the forefront of AI security development. Leverage our experience to keep your data and customers safe!

Rule-based vs ML-based fraud detection

Most banks have some form of rule-based fraud detection system that works according to a set of manual rules and statistical analysis algorithms. Rule-based systems can easily flag suspicious events like transactions over a certain amount of money, activity from blacklisted countries, or login attempts from multiple locations in a short time. While such systems were sufficient in the past, they lack the adaptability to detect evolving fraud tactics.

Here’s how they perform compared to detection systems powered by machine learning:

| Rule-based | Machine learning | |

|---|---|---|

| Application | Detection of known fraud attempts | Data-driven detection of zero-day and first-day fraud |

| Workflow | Manual definition of fraud indicators to detectReal-time detection of predefined fraud flags | Definition of fraud based on historical dataReal-time detection of any unusual activity |

| Key use cases | Simple, known fraud patterns (e.g. large or rapid transfers) | Complex and evolving fraud types (e.g. social engineering and deepfake scams) |

| Precision | Moderate and consistent | High precision that gets better over time with appropriate training |

| Scaling | Challenging to process large datasets with stable performance | High scalability |

| Flexibility | Requires manual updates for changes | Easily learns and adapts to new fraud patterns |

| Development and implementation difficulty | Low to moderate | High; requires deep expertise in data science, ML development, and infrastructure design |

| Maintenance cost and effort | Continuous stable maintenance | Requires routine maintenance, training, and relearning |

ML-based fraud detection systems require more computing and human resources, knowledge, and effort to implement and maintain. However, such software can detect a wider range of fraud attempts and suspicious activity, helping banks to establish a more reliable cybersecurity system. ML-based software can also augment rule-based solutions and reduce the total cost of development and maintenance.

How ML helps in detecting bank fraud

Machine learning algorithms shine in cases where banks need to detect and prevent complex fraud attempts that require long-term setup, are well-masked, or involve some legitimate activity (e.g. insider threats).

Here’s when it’s best to use machine learning for fraud detection in banking:

1. Transaction monitoring

Modern banking systems require real-time, scalable transaction monitoring solutions to detect intricate and evolving threats before they cause real damage. ML models integrated into transaction monitoring continuously assess activity across accounts, geographies, and time windows to detect changes in spending behavior, transfer patterns, or account linkages.

For this purpose, banks can use ready real-time analytics platforms (such as Flink, Kafka, or Spark) or build custom solutions integrated with models like:

- Recurrent neural networks and temporal convolutional networks for sequential pattern recognition

- Graph neural networks for analyzing entity relationships in transaction networks

2. Anomaly detection

Anomaly detection in banking involves identifying transactions, account behaviors, or access patterns that deviate from established norms. To detect anomalies, machine learning models first analyze vast volumes of transaction data to establish a statistical or behavioral baseline. Anomaly detection systems are used not only for flagging real-time transactions but also for monitoring customer accounts over time and identifying compromised accounts or early signs of insider activity.

Anomaly detection solutions are usually based on deep and variational autoencoders, which allow software to capture complex patterns in high-dimensional data. Banks also use clustering algorithms like K-Means to segment users and detect anomalies within peer groups, improving detection granularity.

Compared to rule-based systems, these models improve the speed and accuracy of fraud responses, as well as the range of fraud activity a bank can pick up on.

3. Identity theft prevention

Machine learning-based identity verification allows banks to detect and stop unauthorized access in real time without compromising the user experience, reducing account takeover incidents and credit card fraud.

To do that, machine learning models like logistic regression and random forests analyze features such as login time anomalies, geolocation, device fingerprints, and transaction patterns across multiple channels. You can embed these models into mobile banking apps or authentication workflows to dynamically validate a user’s identity.

4. Risk scoring

Traditional risk scoring methods rely heavily on static rules and credit histories, which can overlook new threats or result in biased outcomes for certain demographic groups. ML-based risk scoring offers a more dynamic, contextual, and real-time view of risk.

Banks often use gradient boosting machines such as XGBoost, LightGBM, and CatBoost to create risk scores based on hundreds of data entries, including:

- Transaction frequency and velocity

- User demographics and device attributes

- Historical fraud labels

- Time series signals

- Behavioral patterns

These models assign a probability score to each transaction or application, allowing banks to automatically approve low-risk actions, reject high-risk ones, and route medium-risk cases to human analysts. Some companies also use reinforcement learning to adapt their risk thresholds to ever-changing threats.

5. Insurance claims verification

Fraud detection helps financial organizations analyze insurance claims for exaggeration, duplication, or fabrication. Adding ML models to the process helps accelerate claims processing, reduce manual reviews, reduce payout losses, and ensure regulatory compliance.

Supervised models like XGBoost and random forests assess features such as claim amount anomalies, submission timing, and policyholder history to flag suspicious claims. Computer Vision using convolutional neural networks inspects submitted images like scanned documents and photos for duplication, tampering, or metadata mismatches. These systems can also correlate claims with external data sources (such as weather or public records) to validate context.

6. Fraud case analysis

Fraud and anti-money laundering case analysis involve uncovering hidden patterns across large, diverse datasets. ML augments traditional fraud analysis systems by applying:

- Entity resolution and graph analytics to trace money flows across accounts

- Clustering to identify groups of accounts or transactions with suspicious similarities

- Anomaly detection within a suspicious activity report (SAR) to facilitate investigations

Advanced systems also integrate natural language processing (NLP) algorithms to summarize and analyze narratives in SAR filings.

ML models help banks improve the speed, accuracy, and scope of fraud investigations and AML compliance, as well as lower the rate of recurring fraud and safeguard clients’ funds.

These are only the key applications of ML-based fraud detection. Banks can also use such solutions to detect phishing attempts, prevent synthetic identity use, and enhance Know Your Customer processes. In the next section, we take a deeper look at the fraud detection capabilities of different types of machine learning.

Read also

Implementing Artificial Intelligence and Machine Learning in Cybersecurity Solutions

Uncover how AI-powered analytics and ML-driven pattern recognition are changing the way organizations defend against cyber attacks and data breaches.

Types of ML algorithms to use for fraud detection

Machine learning algorithms differ widely based on their workflow, the data they require, and the output they produce. Different types of ML algorithms can be used for different tasks within fraud detection and banking processes.

Without diving too deep into the details of machine learning algorithms, here’s how the key types work:

- Supervised learning uses a labeled dataset to train a model. In this dataset, each input example is paired with an expected output. The model learns from examples where the input and correct output are known, enabling it to make accurate predictions based on new, unseen data. Supervised learning algorithms include logistic regression, decision trees, and random forests. The performance of supervised models is heavily dependent on the quality and volume of labeled data.

- Unsupervised learning involves training models on data that has no explicit labels or target variables. The goal of these algorithms is to discover hidden patterns, groupings, or structures within the data. Techniques such as clustering (K-Means, DBSCAN, hierarchical clustering) group data points based on similarity, while dimensionality reduction methods (PCA, t-SNE, UMAP) reveal latent features. Anomaly detection techniques like isolation forests, one-class SVMs, and autoencoders focus on identifying data points that differ significantly from the majority distribution.

- Reinforcement learning involves learning to make decisions by interacting with an environment and receiving feedback in the form of rewards or penalties. Over time, the algorithm learns optimal actions through trial and error. Unlike supervised learning, reinforcement learning doesn’t require labeled input/output pairs. Instead, the algorithm receives feedback in the form of scalar rewards or penalties after each action. Banks usually rely on Q-Learning, SARSA, or policy gradient methods for reinforcement learning.

- Deep learning is based on artificial neural networks with multiple layers. These algorithms can automatically learn complex representations from raw data like sequences, text, or images. Deep learning models can automatically extract features from data, outperforming traditional models when trained on large datasets. Common examples of deep learning include convolutional neural networks for images, recurrent neural networks and long short-term memory for temporal sequences, and transformers for high-context sequential modeling.

Implementing each of these types of algorithms involves its own procedures and challenges. However, we can help you with basic steps and share practical insights we’ve collected after building dozens of custom ML-based systems. Let’s take a look at the major challenges you may face and ways you can tackle them.

Read also

AI in FinTech: Trends, Use Cases, Challenges, and Best Practices

Explore how you can use artificial intelligence to reshape FinTech through smarter fraud prevention, improved credit scoring, and automated financial analysis across services.

Challenges of implementing ML-based fraud detection: Apriorit’s approach

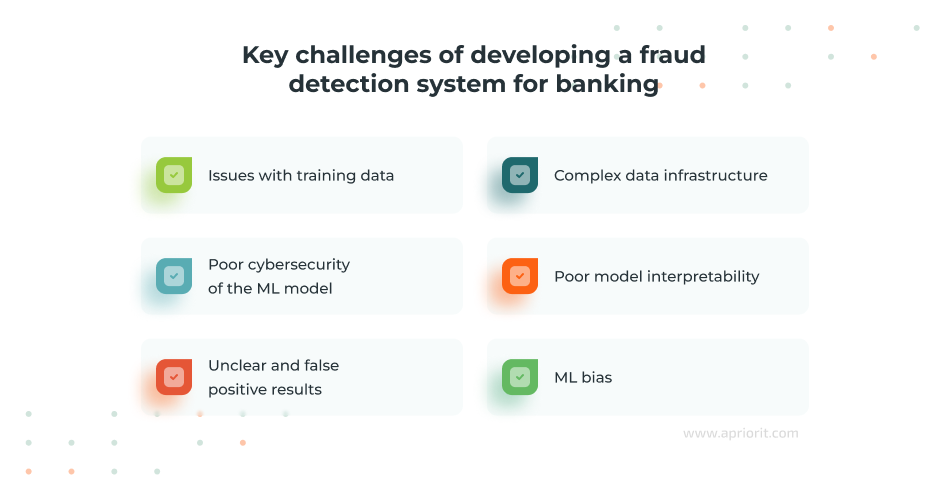

When developing a new ML-based fraud detection solution or implementing new features into your existing ecosystem, you need to take into account the challenges of both working with an ML model and building a FinTech solution.

When we at Apriorit work on machine learning for banking fraud detection, we pay attention to the following aspects:

Issues with training data

Machine learning techniques rely heavily on banking data for fraud detection. True fraud cases are typically a very small minority of banking records, resulting in highly imbalanced datasets. Labels may be inaccurate due to undetected fraud or misclassified legitimate transactions. If these issues aren’t addressed, a model may struggle to learn meaningful patterns and detect fraud.

Another issue of collecting and managing training data is ensuring its security. Training datasets usually contain highly sensitive financial records. If the dataset isn’t properly handled or the ML model is left unprotected, it can lead to a severe data leak.

Apriorit addresses this challenge by:

- Providing assistance and consultation to help clients gather, prepare, and correctly label their data for ML training

- Using AI to generate synthetic records to supplement lacking data entries or avoid using highly sensitive data

- Applying data anonymization to make it impossible to trace sensitive data to real bank clients

Complex data infrastructure

Fraud detection systems must ingest and process data from multiple sources in real time: transaction logs, account activity, behavioral signals, device information, etc. If the infrastructure is fragmented, slow, or poorly integrated, the model may receive incomplete or outdated data and won’t be able to efficiently detect fraud attempts in real time.

Apriorit addresses this challenge by:

- Implementing a real-time stream processing framework based on a scalable streaming architecture that combines message queuing and real-time processing to efficiently gather data in one place and process it live

- Building custom integrations with other corporate software to ensure efficient, scalable, and secure communication

Poor cybersecurity of the model

ML models can introduce new attack surfaces into banking systems. Malicious actors can try model evasion, data poisoning, model extraction, and other attacks. If successful, these attacks allow them to abuse or break a fraud detection system, or even steal the data it uses.

Apriorit addresses this challenge by:

- Using a secure SDLC during development to ensure that your system is protected at any stage of development and after deployment

- Adhering to relevant cybersecurity compliance requirements, which usually include best practices to safeguard sensitive data

- Implementing robust access control to prevent the risk of insider attacks and limit the potential attack surface

- Making sensitive data inaccessible for malicious actors by encrypting it at rest, in use, and in transit

Read also

Predictive Analytics in the Banking Industry: How to Prepare for Integration (+Implementation Tips)

Align risk, compliance, and sales around one shared view of each customer’s future behavior instead of relying on disconnected spreadsheets and instincts.

Poor model interpretability

High-performing AI and ML models, especially ready solutions, work as a black box. Lack of transparency makes it impossible to explain how an ML model made a particular decision. This is an issue in regulated industries like banking, where legislation, auditors, and internal stakeholders require clear explanations.

Apriorit addresses this challenge by:

- Using SHAP, Lime, and summary and dependence plots to explain ML’s thought process and decisions

- Avoiding using black-boxed tools and models during development

- Providing detailed and clear documentation for each element of the ML-based system

Unclear and false positive results

ML-based fraud detection systems can generate many alerts that are either false positives or lack sufficient explanation. Such results can reduce the efficiency of the whole fraud detection system and frustrate customers. They can also require additional manual work from fraud analysts and compliance specialists, reducing their trust in the system and taking their time.

Apriorit addresses this challenge by:

- Adding reporting and visualization features to help analysts understand ML results and present them to company stakeholders

- Interpreting fraud detection results using knowledge graphs, which help unite and organize complex arrays of data and detect fraud patterns

- Fine-tuning algorithms to reduce the number of false positive results

ML bias

Any AI and ML algorithm has built-in bias. Biases can be introduced by skewed training data, unbalanced features, or modeling choices that disproportionately impact certain user groups. In fraud detection, this could mean higher false positive rates for users from specific regions or demographics, or users with specific behavior patterns. In turn, this could lead to reputational damage and regulatory violations.

Apriorit addresses this challenge by:

- Ensuring that the training datasets we use are diverse and balanced, and using third-party or synthetic data to augment real records

- Conducting bias testing before release

As you can see, developing a secure, efficient, and performant fraud detection system requires experience and deep industry knowledge. Hiring and training an in-house team that can take on this task is extremely time- and resource-intensive. Instead, you can reach out to Apriorit’s team and leverage our niche skills

How can Apriorit help you implement ML-based fraud detection?

As a company with deep expertise in AI and ML development, we’ll help you build a custom solution that fits your business perfectly. That includes helping you choose and train a suitable model, secure it with necessary measures, fine-tune its performance, design an intuitive UI/UX, and release it within the discussed time frame.

When working with Apriorit, you can expect:

- Access to rare development expertise. Over the years, Apriorit teams have accumulated rare and niche knowledge on AI, ML, and FinTech development. Taking into account the talent shortage in IT, working with us helps you significantly reduce the time needed to build your project team and get the skills you need.

- Real-life solutions for FinTech development issues. We know typical challenges in security, performance, and compliance of FinTech products, and we will help you navigate them at the initial stages of the project. This way, you’ll either completely avoid these challenges or significantly reduce their impact on your product.

- Security-focused development. As a security-first company, we make sure your product is protected at every stage of development with a secure SDLC. Our processes always include implementation of must-have security features like encryption, access control, and authorization.

- Detailed and clear documentation. To help you deliver a transparent and traceable ML solution, we focus on using open-source or clearly documented roles and models. Our team also generates detailed documentation for any system we build. This way, you’ll be able to explain how it works and improve it in the future.

- Model support and retraining. Any machine learning model needs to be adjusted over time to keep its output precise and relevant. We’ll support, maintain, and upgrade your system, helping you detect and combat emerging threats.

Conclusion

Financial fraud evolves every day, and banks’ fraud detection systems must evolve in parallel to be able to protect customers. By leveraging different learning paradigms, from supervised models to deep learning architectures, financial institutions can uncover complex fraud patterns that traditional rule-based systems often miss. Banks can also combine ML models with rule-based detection to make their systems even more flexible and resource-efficient.

However, developing an ML-based fraud detection system requires more than just accurate models. It demands high-quality training data, robust infrastructure, secure deployment, and continuous evaluation to minimize false positives and maintain user trust.

Apriorit’s FinTech development specialists will help you build a custom nuanced system that ensures compliance with legal requirements, protects your customers’ data and funds, and prepares your company to meet future cybersecurity risks.

Get a reliable and experienced FinTech development partner

Reach out to Apriorit’s team and start building the solution you need without the headache.