SaaS accounting software helps businesses streamline processes, reduce errors, and cut costs, but off-the-shelf solutions often fail to meet unique business needs. To fully realize the potential of your services, you should seek a tailored approach. Developing a custom SaaS accounting solution is the ideal choice. By creating your own platform, you can efficiently address your customers’ unique needs and find your niche in the SaaS accounting market.

In this article, we discuss why and how to build your own custom SaaS solution for accounting. We analyze what architectural elements to choose and what features are a must for a modern solution. This article will be useful for team leaders and product managers planning to build custom web applications for accounting.

Contents:

- Why do businesses choose cloud-based accounting?

- Why off-the-shelf accounting software isn’t enough

- Designing an architecture for a SaaS accounting solution

- What features will make a SaaS accounting product competitive?

- What to consider when building a SaaS accounting solution

- How Apriorit can help with custom SaaS solutions

- Conclusion

Why do businesses choose cloud-based accounting?

Software as a Service (SaaS) accounting software has become a go-to solution for businesses looking to streamline routine processes, minimize administrative overhead, reduce human errors, and cut costs. These cloud-based platforms offer accessibility and convenience, but off-the-shelf options often fall short of meeting the specific needs of individual businesses.

Both large enterprises and startups have reasons to choose SaaS-based accounting software over alternatives:

1. Scalability and flexibility. SaaS solutions are designed to grow along with your business. They can easily scale to accommodate increased transaction volumes, more users, and evolving business needs.

2. Moderate pricing. A SaaS product can be more affordable than its ready-made analog. Any traditional solution requires heavy expenses on software licenses and critical updates and hardware to run it, while SaaS services are usually distributed under a subscription or pay-per-use model.

3. Integration capabilities. In a modern organization, IT solutions work together to create a complex IT ecosystem. Therefore, being compatible and able to integrate with other corporate software can make your SaaS accounting product more competitive.

4. Enhanced data accessibility. One of the main advantages of SaaS technology is the possibility to access users’ data on any platform and device. This flexibility boosts teamwork, provides real-time financial insights, and helps businesses make informed decisions without being tied to a specific location or device.

5. Strong data security. Corporate financial information is one of the most strictly protected categories of data. SaaS solutions have to follow strict industry standards to build trust and keep critical business information safe.

6. Automation. By automating repetitive tasks such as invoice generation, payroll calculations, and tax reporting, a SaaS accounting solution reduces human error, saves time, and allows your team to focus on higher-value activities. Automation also improves the accuracy and speed of financial processes, leading to better operational efficiency.

The benefits and applications of SaaS accounting vary based on the specific solution and its purpose. Let’s see what types of solutions you might encounter.

Plan to build an accounting application?

Let us design and implement a custom solution that fits your requirements.

Common types of SaaS accounting solutions

The needs of businesses for accounting solutions often depend on their accounting tasks. Here are common types of SaaS accounting solutions:

- General accounting software covers basic functions like bookkeeping, invoicing, expense tracking, and reporting. These solutions are suitable for small business accounting and personal use.

- Payroll management software specializes in automating payroll processes, tax calculations, and employee benefits. Compared to general accounting solutions, payroll management solutions are designed for growing companies and include more advanced features such as multi-user support, budgeting, and tax compliance.

- Enterprise resource planning (ERP) systems provide comprehensive financial management alongside operational tools for functions like inventory and supply chain management. For large organizations, these platforms also offer tools for multi-entity accounting and global compliance.

Businesses can choose between ready-made SaaS solutions for any of these software types. However, off-the-shelf solutions might not fully address every organization’s unique needs. This has led many companies to build custom SaaS accounting systems, which can be tailored to fit specific business processes, workflows, and integration needs. Let’s take a look at why businesses opt to build custom solutions.

Read also

Developing a MVP for SaaS: Technical Insights

Explore the concept of an MVP and reduce the risk of investing in a fully featured product that may not meet user expectations. We share our tips on developing essential features to test your product’s market viability.

Why off-the-shelf accounting software isn’t enough

Whether you should choose ready-made software or custom SaaS accounting solution development depends on your business’s needs and priorities. Let’s explore the criteria for choosing in detail.

Table 1. Comparing ready-made and custom SaaS accounting solutions

| Criterion | Ready-made solution | Custom solution |

|---|---|---|

| Cost | Lower upfront cost but recurring subscription fees | Higher initial cost, potentially lower long-term cost |

| Availability | Immediate availability | Delayed availability |

| Support | Standard updates from the vendor | Tailored support from your development team |

| Customization | Limited to no customization | Full customization |

| Workflow alignment | Not always aligned with your workflows | Seamless integration with your workflows |

| Data control | Limited control of data stored on the vendor’s servers | Full control over data and hosting |

| Ownership | No ownership with vendor lock-in | Full ownership of the software |

| Security | Depends on the vendor’s security protocols | Custom security measures tailored to your needs |

As you can see, custom SaaS accounting solutions stand out for their ability to provide unparalleled flexibility and personalization. To maximize the benefits of your custom software, you need more than tailored features. A reliable architecture is essential for achieving scalability, performance, and security, which are all key elements for the long-term success of your product. Let’s take a look at the architecture design process and what makes a SaaS accounting solution dependable and ready for growth.

Read also

How to Ensure SaaS Data Security with Curated Database Design

Discover how database design influences solution security and how to create reliable and efficient databases.

Designing an architecture for a SaaS accounting solution

Offering a rich set of features for an affordable price won’t win you lots of customers in the long term if they don’t come alongside full availability and high performance.

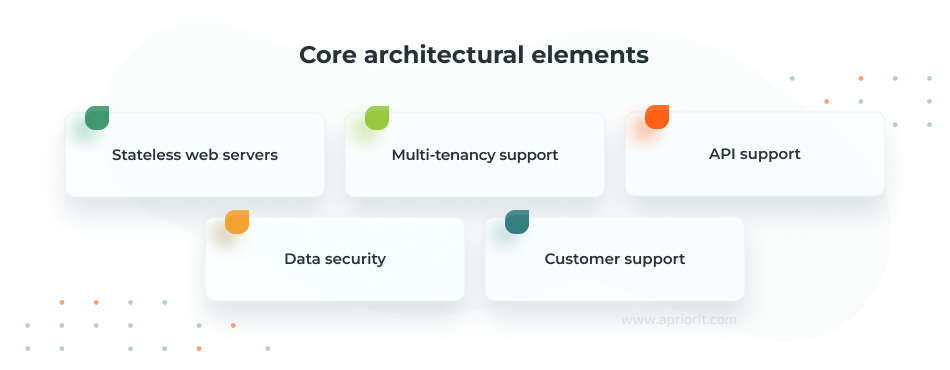

Here are the core elements you can use as the basis of your SaaS accounting solution’s architecture:

Stateless web servers. During accounting software development, one of the first things to consider is that SaaS products are web applications that don’t maintain a defined local state. Therefore, a shared database, with which the architecture can support no-touch elasticity, is critical. It’s difficult (if not impossible) to make an accounting system when web servers are configured with a local state. Stateless web servers process requests independently, enabling horizontal scaling and high availability. They are crucial for handling fluctuating user traffic and ensuring consistent performance.

Multi-tenancy support. A SaaS solution with a multi-tenant architecture can be built on a common infrastructure yet offer individual services to a wide customer base. In a multi-tenant environment, the data of individual tenants is strictly separated. To ensure this separation, the system needs to identify each tenant by an ID that is employed at the application and database layers and linked to individual users. An identified user gets full access to their data while having zero access to the data of other users. This architecture allows multiple customer accounts to share the same underlying infrastructure while maintaining data isolation and security.

API support. Implementing APIs helps you customize your application with other tools such as CRMs, ERPs, and payment gateways. APIs allow advanced users and third-party developers to create additional components to enhance your solution and integrate their products with, thus building a comprehensive ecosystem. This will help you and your customers achieve a more connected and streamlined workflow.

Customer support. Today, 24/7 customer support is a must. The SaaS model allows users to access accounting software at any time and in any place. If an issue occurs, a client expects it to be solved as soon as possible. There are a few tricks to make your support team more effective. For example, you can implement an AI-powered chatbot to solve the easiest issues and a helpdesk to keep track of chats and reports. Support operators would appreciate a knowledge base with descriptions of resolutions for common problems. If you use a ticketing system, it’s a good call to create automated tickets based on customer reports.

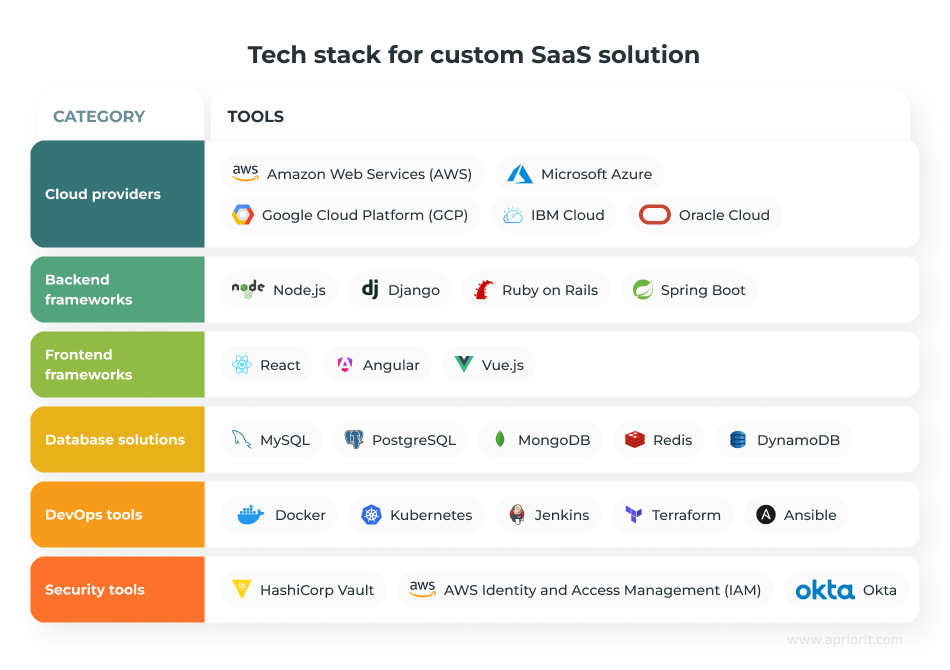

In addition to a robust architecture, you need a modern and comprehensive tech stack. Your team needs to find the right combination of tools, frameworks, and platforms for building a scalable, secure, and efficient cloud-based architecture. Depending on your needs and project details, here are some of the most effective tools to add to your tech stack:

With a strong foundation in place, the next crucial step is to focus on the essential features that will make your SaaS accounting product truly valuable and competitive in the market.

What features will make a SaaS accounting product competitive?

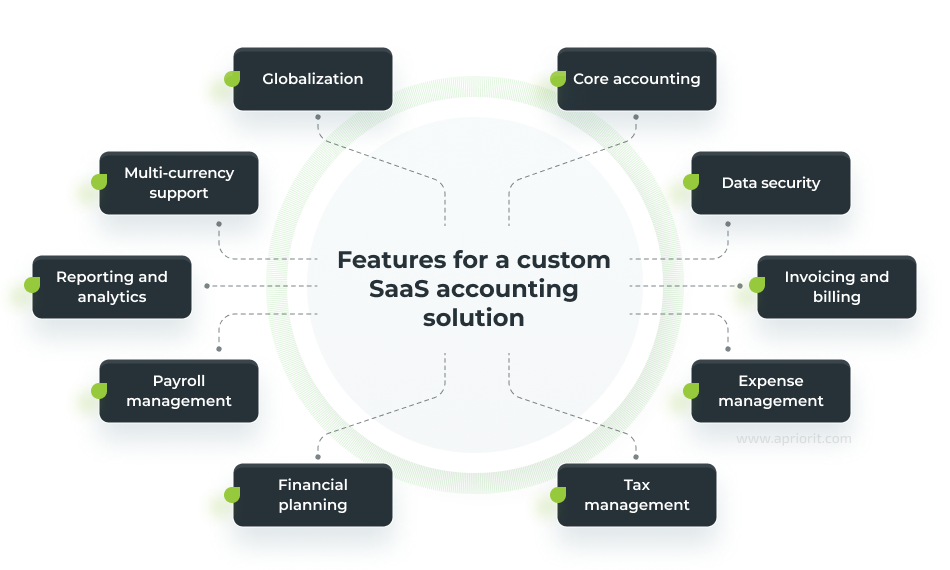

Let’s take a look at a list of the most useful features to consider when building a SaaS accounting application:

Core accounting. The backbone of any accounting system, core accounting functionalities ensure accurate financial record-keeping and reporting by providing users with essential tools for day-to-day financial management. Some of the main core accounting functionalities include:

- General ledger management

- Chart of accounts

- Journal of all financial transactions

Data security. Keep an eye on relevant security standards, both regional and industry-specific, like the GDPR, PCI DSS, and the Sarbanes–Oxley Act (SOX). Data security features help to identify users, manage access permissions, encrypt data, and provide audit trails to prevent unauthorized access and fraud. The main data security features include:

- User authentication

- Access control

- Audit logging

Invoicing and billing. These features streamline payment workflows, making it easier for businesses to manage income and improve cash flow. Automated processes like recurrent billing and reminders help to reduce the administrative workload as well. Here is what you can include:

- Invoice generation

- Payment processing integration for online payments

- Recurrent billing

- Late payment reminders

Expense management. With the help of these features, you can simplify financial oversight and reduce manual errors. Key expense management capabilities include:

- Expense tracking

- Automated categorization

- Detailed reporting

Tax management. This group of features helps businesses remain compliant with tax regulations while minimizing tax-related errors. Tax management features include:

- Tax calculation and reporting

- Compliance support

- Audit preparation

Financial planning. These tools allow businesses to plan their financial future, set achievable goals, and optimize resource allocation. Budgeting and forecasting features also provide insights into potential financial outcomes and help with strategic decision-making. In this group of features, you might find:

- Budget templates

- Cash flow projections

Payroll management. These features automate complex employee compensation processes, ensuring accuracy while reducing administrative effort. Payroll management tools can integrate seamlessly with time tracking systems to provide end-to-end payroll solutions. This group of features can include:

- Direct deposits

- Tax filing and deductions

Reporting and analytics. Advanced reporting and analytics capabilities provide users with actionable insights, enabling them to make data-driven decisions. Your software can generate comprehensive payroll reports, including payroll summaries, tax reports, and employee earnings statements, in addition to offering:

- Customizable reports

- Data visualization

- Real-time analytics

Multi-currency support. Multi-currency features can help you efficiently manage financial operations across different regions by handling multiple currencies with real-time conversion rates. Multi-currency features include:

- Currency conversion

- Multi-currency invoicing

- Financial reporting

Globalization. These features are crucial if your business operates in multiple regions. They make sure that your business stays compliant with diverse regulations, streamline international transactions, and support global expansion. Globalization features include:

- Localization

- Regional tax compliance

- Integration with international payment systems

Adding these essential features to your SaaS accounting solution will help create a competitive product that meets the needs of different users.

Want to know how to create accounting software that will stand out?

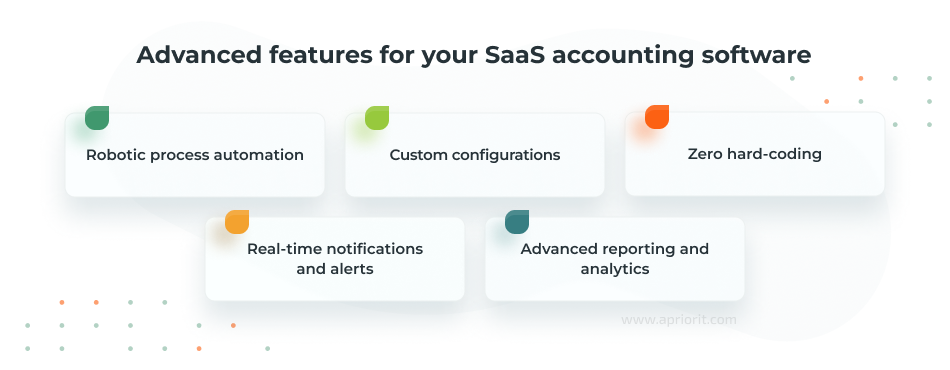

To differentiate your SaaS solution and add value for users, consider integrating more advanced technologies. They not only enhance functionality but also address more customer expectations compared to the standard set of features. Here is what you can add:

- Process automation streamlines repetitive tasks like bank reconciliations, tax calculations, and invoice processing to improve efficiency.

- Custom configurations allow users to customize the appearance of your software, extend the data model, define specific workflows, and implement granular access permissions. This increases the competitiveness of your SaaS solution.

- Zero hard-coding is important for the solution’s security, performance, and flexibility. Engineers must be sure that individual application layers can scale independently without breaking the connection between layers to successfully create a high-performing system.

- Real-time notifications and alerts keep users informed about critical events such as overdue payments, low inventory levels, and potential fraud.

- Advanced reporting and analytics tools (for example, interactive dashboards, customizable reports, and data visualization tools) provide rich visualizations and insights into financial performance.

It’s important to make strategic decisions on the feature set early on. Let’s see what you need to take into account if you want to create a solution that meets users’ needs today and stays competitive in the future.

Related project

Building AWS-based Blockchain Infrastructure for International Banking

Discover how our team designed and deployed high-performance AWS blockchain infrastructure to enable seamless and secure financial transactions for a banking client.

What to consider when building a SaaS accounting solution

Building custom systems comes with nuances, but their ability to precisely align with a business’s needs often makes them a worthwhile investment, particularly for organizations with complex workflows or specific scalability requirements. Before you even start building a custom SaaS product for accounting, consider the following:

1. Understanding customer needs

Make sure your solution meets the actual needs of your target audience. Particularly, pay attention to the current requirements of your target industries, the size of your target organizations, the latest technology trends, and competitor offerings already available on the market. A professional business analyst can help you evaluate the viability of your business idea and outline the core feature set to add to your SaaS product to make it competitive.

2. Implementing robust security

Accounting software deals with sensitive financial data, making security a top priority. You need to build your solution to comply with regional requirements like the GDPR, PCI DSS, and SOX as well as industry-specific requirements. Your custom solution should include features like encrypted data storage, role-based access control, and activity tracking to protect sensitive user data and enhance trust.

3. Ensuring high quality

To deliver a quality and secure product to your customers, consider implementing the shift-left principle to integrate testing early in the development process. This approach ensures consistent performance and security by identifying and addressing issues before they escalate. Your team should also plan for thorough testing of critical features, performance metrics, and system reliability to deliver a high-quality product.

4. Adhering to regional and industry-specific requirements

Different industries and regions have unique accounting and compliance standards. For example, in the United States, compliance with Generally Accepted Accounting Principles is essential for financial reporting. In the European Union, companies must adhere to International Financial Reporting Standards. Additionally, SOX in the US and the GDPR in the EU mandate strict data handling and financial transparency protocols. Tailor your solution to meet these specific requirements, such as tax regulations, financial reporting standards, or audit requirements, to ensure seamless adoption across different markets.

5. Balancing feature diversity with usability

Your SaaS accounting solution must have a diverse set of features to fully meet the needs of your customers and your business. However, too many complex functionalities can overwhelm users and make workflows vague and confusing. The challenge is to provide essential tools like automation, integration, and real-time reporting while keeping the interface intuitive and the operations clear and efficient.

6. Planning for future changes to the product

Think about additional technologies, services, and advanced capabilities you might want to implement later. And make sure that your current architecture and feature set won’t get in the way of these improvements. A scalable and adaptable foundation will save you significant effort and resources as your product grows.

To successfully navigate these challenges, you might need an experienced partner with a focus on security and user experience.

Related project

Building a Microservices SaaS Solution for Property Management

By transitioning our client’s property management software from a monolithic to a microservices-based architecture, Apriorit addressed legacy code challenges and improved platform flexibility. We managed to create a modernized design, enhance scalability, and boost user satisfaction with the client’s solution.

How Apriorit can help with custom SaaS solutions

Developing a custom SaaS accounting solution requires a team skilled in cloud development, data security, and architecture design. At Apriorit, we specialize in delivering tailored SaaS platforms that meet unique business needs while ensuring your software’s reliability, efficiency, and long-term success. Here is what you can expect from partnering with us:

Deep SaaS expertise. With years of experience in SaaS platform development, we’ve built solutions for many industries including HR, fintech, and cybersecurity. Our team understands the challenges of developing secure, scalable, and high-performance SaaS applications.

Cloud-native optimization. Our expertise in cloud technologies will make your SaaS product highly available, resilient, and cost-efficient. Apriorit experts can design cloud-native architectures and manage your cloud infrastructure.

Focus on user experience. A SaaS platform’s success depends on how effectively it meets user needs. At Apriorit, our developers work closely with designers to create a user-centric design, intuitive navigation, responsive interfaces, and seamless workflows.

Expert business analysts. Building a successful SaaS product starts with a deep understanding of business goals and user needs. Our skilled business analysts work closely with you to define requirements, identify key challenges, and make sure your solution aligns with market demands.

Enterprise-grade security and compliance. SaaS solutions handle users’ personal data, financial transactions, and business operations, making security a top priority. That’s why security is integrated into every stage of our development process, ensuring the delivery of products that comply with the GDPR and PCI DSS. With data encryption, access controls, and real-time monitoring, we help protect your platform against various cyber threats.

By partnering with Apriorit, you gain a trusted ally capable of transforming your SaaS vision into a reliable, secure, and user-friendly product that drives business growth.

Conclusion

Developiong custom accounting software requires thorough planning of the SaaS software development lifecycle: architecture, feature set, future upgrades, etc. The ready solution needs to match the demands and expectations of its target audience and be competitive enough to stay in the market.

Apriorit’s dedicated teams will gladly assist you at each step of this thrilling journey, from in-depth market analysis and architecture development to functionality extension and quality assurance.

Let’s build a competitive SaaS solution together!

Partner with Apriorit to get development expertise and turn your business idea into reality.