Key takeaways:

- Artificial intelligence (AI) and machine learning (ML) are currently two of the most in-demand technologies for FinTech solutions.

- Financial companies use AI for tasks like credit risk assessment, fraud prevention, and customer support.

- Benefits of AI in FinTech range from increased operational efficiency to hyper-personalization of services.

- Strict but fragmented compliance requirements, technology limitations, and talent shortages make implementing AI a challenging task for FinTech companies.

Artificial intelligence (AI) and machine learning (ML) are no longer bold experiments or optional add-ons. These technologies are becoming the go-to option for financial organizations and startups that want to optimize operations and deliver more value to their customers.

For leaders of digital payment platforms, banks, and other financial organizations, the conversation has moved beyond if to how:

How do you implement AI into your product in a way that’s secure, compliant, and actually delivers on its promise?

This article will provide you with answers to this complex question. We discuss the latest trends and the future of AI in FinTech, cover main industry use cases for this technology, and offer actionable advice for tackling key challenges of AI adoption.

Contents:

The role of AI in FinTech

Industry players of all scales — from traditional banks and insurance agencies to small startups — are making AI and ML an integral part of their ecosystems. These technologies power everything from customer service automation and personalized financial advice to advanced fraud detection.

And the market reflects this trend. According to the Artificial Intelligence (AI) FinTech Business Research Report 2024 by ResearchAndMarkets, the global market for AI in the FinTech industry is forecasted to grow from a bit over $22 billion in 2023 to over $79 billion by 2030. That’s more than tripling in just seven years — a sure signal that AI technology is not only here to stay but is scaling fast.

At the strategic level, AI is no longer limited to improving personnel efficiency.

Financial organizations deploy AI-based solutions to upgrade their services, extract deep and actionable insights from data, and quickly respond to dynamic markets.

A lot of attention is paid to generative AI (GenAI) tools and AI agents, as they open even wider possibilities for complex process automation and advanced personalization of financial services. Gartner predicts that by 2028, AI agents will be part of about a third of all enterprise software solutions.

In this new reality, technical leaders and product owners must understand how to leverage AI responsibly and securely while also delivering sustainable ROI for their businesses. In the following sections, we will show you how to do that.

Looking to integrate AI and ML into your product?

Partner with Apriorit to develop, train, and deploy intelligent systems tailored to your industry and business needs.

Top use cases for AI in FinTech

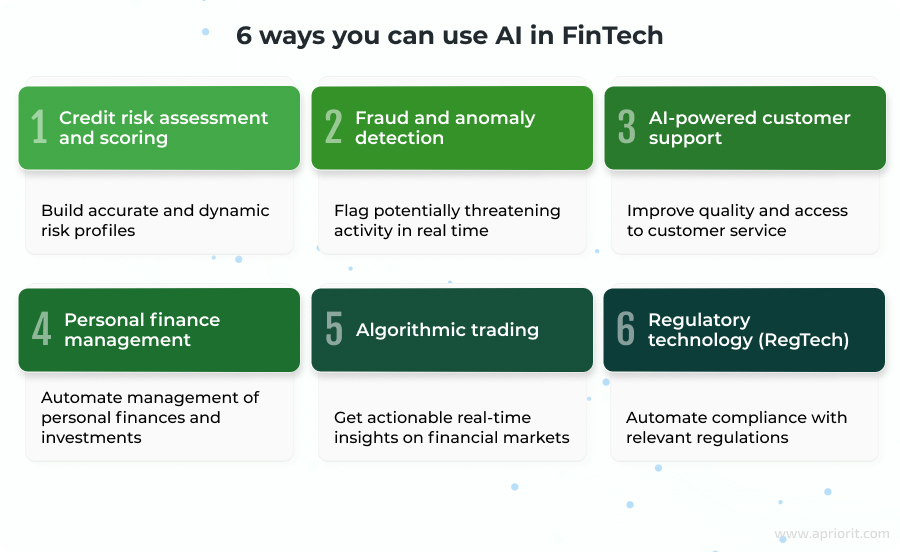

How is AI used in FinTech? With the ongoing evolution of AI, the range of possible use cases for this technology is also expanding. Below, we list some of the most common ways FinTech organizations and startups can use AI in their solutions:

1. Credit risk assessment and scoring

Traditional credit scoring often fails to capture the full financial picture, especially for individuals with limited credit history. AI-powered models can analyze a broader set of structured and unstructured data, including income flows, employment history, banking transactions, education, and online behavioral patterns.

Platforms like Upstart and Zest AI are leading this shift. They use machine learning to improve risk assessment accuracy and enable more inclusive and dynamic credit evaluations. As a result, they can open lending opportunities for underbanked users while preventing an increase in default rates.

2. Fraud and anomaly detection

Banking and financial organizations can use AI to detect and mitigate incidents like payment and card fraud, money laundering, account takeover, and identity theft. AI provides real-time, adaptive fraud protection by learning and establishing a baseline for what can be seen as normal behavior or activity. Analyzed data can range from parameters like user locations, used devices, and login times to payment patterns. Any significant deviation from the set norm gets flagged as an anomaly and a sign of potential fraud.

Visa recently launched a generative AI-powered solution that aims to identify account attacks in real time and reduce fraud. PayPal also leverages AI in its enterprise solutions for real-time fraud detection.

3. AI-powered customer support

AI-driven customer service has become essential for scalable, 24/7 engagement. Chatbots and virtual assistants now handle everything from balance inquiries to dispute resolution, all while learning from each interaction to improve accuracy and contextual awareness.

Bank of America’s Erica, a virtual assistant integrated across the bank’s mobile channels, helps clients with tasks like managing their subscriptions, analyzing spending habits, and exploring refund options. Klarna and Morgan Stanley are also embedding conversational AI into their apps and portals, aiming to reduce response times and boost user satisfaction.

Related project

Streamlining Electric Vehicle Charging Support with an AI Chatbot

Explore how Apriorit helped a client in the EV industry enhance user satisfaction and support efficiency by developing a custom AI chatbot for real-time assistance at charging stations.

4. Personal finance management

AI isn’t only meant for institutions — this technology is reshaping the way people manage their personal finances. AI can analyze spending habits, income, and bills to provide users with tailored insights on how to achieve their financial goals.

Services like Cleo and Betterment use AI to help customers track spending and identify savings opportunities.

5. Algorithmic trading and AI-based portfolio management

AI-powered solutions can generate actionable trading insights by gathering and processing information from news feeds, real-time market data, social media sentiment, and analyst reports. Common tasks for AI in portfolio management include portfolio optimization, profile risk management, and asset allocation. Robo-advisors also account for a user’s financial goals and personalized risk profiles, using that information for automated investment management.

InvestGlass leverages AI capabilities to deliver personalized investment strategies, while HSBC uses natural language processing (NLP) for advanced market analysis and provides investment insights to its clients.

6. Regulatory technology (RegTech)

With growing regulatory complexity, financial organizations are turning to AI to automate compliance tasks and reduce their risk exposure. ML-powered RegTech solutions streamline know your customer (KYC) processes, monitor transactions for anti-money laundering (AML) red flags, and simplify reporting across jurisdictions.

ComplyAdvantage is a RegTech company that uses NLP to scan global watchlists and news in real time and alert compliance teams to emerging risks. HSBC also applies AI in anti-money laundering programs, aiming to increase the accuracy of money laundering risk detection, speed up response times, and identify criminal networks.

Read also

Establishing Software Development Compliance: Challenges, Best Practices, and Requirements Overview

Stay ahead of regulatory demands and make compliance an integral part of your software development workflow. Discover steps to align with HIPAA, GDPR, PCI DSS, and other critical compliance requirements from day one of your product’s development.

Business benefits of using AI in FinTech solutions

As you can see from the use cases of AI in FinTech, this technology is completely changing how financial services are built, delivered, and consumed. When implemented strategically, AI technology helps FinTech businesses get access to a number of meaningful improvements:

One of the most obvious and immediate wins of AI adoption in FinTech is increased operational efficiency.

Products and features enhanced with AI excel at automating repetitive, time-consuming processes like data entry, transaction reconciliation, and compliance checks. These tasks are traditionally resource-heavy and prone to human error and bottlenecks.

With intelligent automation, banking organizations and financial companies can speed up service delivery and significantly reduce administrative and operational overhead. Human employees, on the other hand, will still be needed to oversee the results of AI’s work and to tackle particularly important, creative, and high-value tasks.

Along with operational enhancements, AI can improve the quality and security of FinTech services by automating fraud detection and risk assessment through real-time data analysis.

Integrating AI-powered solutions enables financial organizations to build dynamic and highly accurate risk profiles, strengthen the security of user accounts and transactions, and reduce the risk of breaches by supporting threat intelligence and behavior-based authentication systems.

Implementing AI-powered analytics also enhances strategic decision-making.

Financial organizations generate and process lots of data, from customer behavior and transaction logs to macroeconomic indicators. Having an AI-powered analytical system can help FinTech businesses make sense of all that data.

Such a system can transform raw records into actionable insights, enabling finance professionals to better identify emerging market trends, determine untapped customer segments, and plan the development of innovative financial products.

Finally, AI-powered solutions can offer advanced personalization of FinTech products and services, which customers are rapidly coming to expect rather than see as a luxury.

AI allows FinTech platforms to deliver hyper-personalized experiences, from financial advice to loan offers and spending insights. By learning from individual user behavior, AI helps tailor services to boost engagement, loyalty, and long-term customer value.

However, implementing AI comes with a number of challenges. Let’s learn what they are and how to mitigate them.

Read also

Generative AI vs Predictive AI: Which to Choose for Your Business

Make smarter choices when enhancing your products with AI! Learn the key technical and business distinctions between generative and predictive models, with examples of how each can drive innovation for your business.

Challenges of AI adoption in FinTech and how to overcome them

When starting an AI journey, your business will face multiple obstacles, ranging from talent shortages and technological limitations to regulatory and ethical restrictions on AI use.

Understanding and addressing possible challenges early is critical for the successful integration of AI-powered capabilities.

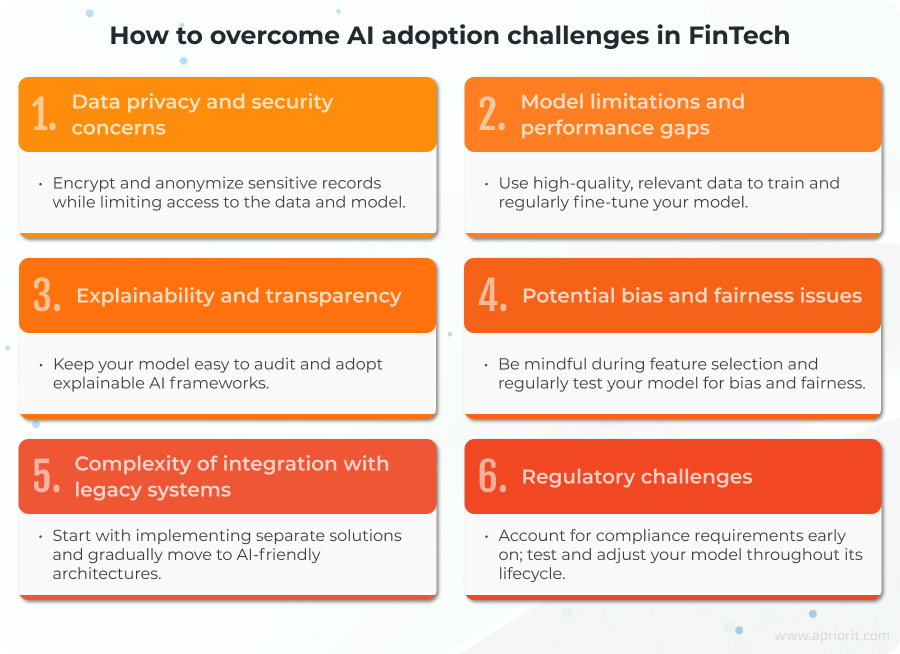

1. Data privacy and security concerns

AI systems require access to large volumes of sensitive financial data: customer profiles, transaction histories, behavioral insights, and so on. This raises serious questions about data privacy and protection, especially when using that data for training models or granting third-party AI services access to it.

Cybercriminals often target critical data first and look for weak spots in your systems to gain access to it. Leaders of financial firms recognize this danger and rank cybersecurity as the highest potential systemic risk for AI adoption.

If your AI-powered solution lacks mechanisms for securely processing sensitive financial data or relies on unreliable third-party components, your business will be at risk of data leaks, misuse, or breaches, as well as loss of customer trust.

Here’s what your development team can do to mitigate these risks:

- Anonymize or pseudonymize critical sensitive data before using it in model training so that no records can be traced back to the original sources and particular people.

- Implement strong encryption mechanisms for data at rest and in transit.

- Set strict access limitations and apply measures like multi-factor authentication to prevent unauthorized access to both your model and the data it works with.

You can also deploy your AI model on-premises. This gives your organization full control over how your AI solution handles highly sensitive data, preventing data leakage and ensuring strict regulatory compliance. However, this option requires significant investment, as your team will have to take care of everything from training and integrating the model to scaling and maintaining the entire system.

2. Model limitations and performance gaps

Even the most popular and well-performing AI models have their limits.

For example, the quality and relevance of training data have a huge impact on a model’s performance. If source data is of low quality or misbalanced, the model can provide inaccurate results.

Over time, even a well-performing and accurate AI model can experience model drift or model decay, becoming unable to properly handle real-world data because of differences between input data and the original dataset.

Also, popular models like OpenAI’s ChatGPT and Google’s Gemini operate as black boxes and often lack contextual awareness. Overreliance on such models without human oversight and validation increases the risk of data misinterpretation and unethical financial practices.

To address these issues, your team can:

- Use only high-quality, domain-specific training data — sourced internally or through reliable data providers.

- Establish strong model governance practices, including regular AI model validation, version control, risk scoring, and explainability checks.

- Implement automated retraining and regular monitoring to ensure the model’s stability and performance.

- Require human validation for critical decisions based on AI-generated insights.

Read also

Challenges in AI Adoption and Key Strategies for Managing Risks

We uncover key strategies that will help your business navigate technical and organizational barriers to AI integration.

3. Explainability and transparency

Many high-performing AI models operate as black boxes. While this may be acceptable in some industries, in FinTech, lack of transparency is a deal-breaker.

Stakeholders need to understand how AI makes decisions. Additionally, decision transparency and explainability are essential for regulatory compliance and customer trust. Lack of explainability can make model outputs unreliable and raise bias-related concerns when it comes to processes like credit approvals, fraud detection, or investment advice.

Here’s how your team can improve the explainability of your AI-powered FinTech solution:

- Document the model architecture, training data, and decision logic in detail to enable future audits and compliance reviews.

- Adopt explainable AI tools such as SHapley Additive exPlanations (SHAP) or Local Interpretable Model Agnostic Explanation (LIME) to enable explainability for predictions made by black-box models.

4. Potential bias and fairness issues

As we mentioned, AI models are only as fair as the data they learn from — and financial data often reflects historical inequalities. Without proper safeguards, AI-powered lending or underwriting systems may inadvertently reinforce discrimination based on race, gender, or ZIP code. In the US, such outcomes can even violate anti-discrimination laws.

Recommended steps for mitigating issues of bias and fairness include:

- Carefully select features for your model to exclude variables that could potentially encode bias.

- Conduct regular fairness audits and bias testing throughout the model lifecycle.

- Constantly fine-tune the model, especially as user behavior or data distributions change.

5. Complexity of integration with legacy systems

Many financial institutions still run on legacy infrastructure that wasn’t built with AI in mind. Integrating AI-powered capabilities in such systems can be technically complex, especially when there are no functional APIs or critical data is siloed.

Legacy systems often lack the infrastructure for securely exchanging data, processing data in real time, and scaling performance. Additionally, the data these systems contain is often outdated, inconsistently formatted, or poorly labeled. Without proper preprocessing of such data, AI can generate unreliable insights.

Here’s what will help your team tackle this challenge:

- Take a phased integration approach, starting with AI pilots or wrapping legacy systems with API layers.

- Gradually migrate your product to cloud-native, lakehouse, or real-time architectures that are better at supporting resource-hungry AI workloads than legacy systems.

- Implement a data gateway to prepare and secure data from your repositories, ensuring that only properly structured, quality data reaches your AI model.

6. Regulatory challenges

AI adoption in FinTech is evolving within a growing but still fragmented regulatory landscape. Governments are racing to adapt laws to account for algorithmic decision-making. Compliance requirements such as AML, KYC, PCI DSS, and the GDPR now intersect with AI accountability mandates like ISO/IEC 42001 and the EU AI Act.

In particular, the EU AI Act introduces strict requirements for transparency, human oversight, and risk mitigation of certain high-risk financial AI products.

Below are some key recommendations for keeping your AI-powered FinTech solution compliant:

- Build your product with relevant compliance requirements in mind from the start.

- Ensure decisions are auditable and traceable, especially in consumer-facing applications.

- Use frameworks like the NIST AI Risk Management Framework to test for regulatory alignment throughout your AI-powered product’s software development lifecycle.

These recommendations cover the most common issues you may encounter when adding AI capabilities to FinTech solutions.

Many financial companies also face talent shortages when starting their AI journey — skilled AI engineers, data scientists, and MLOps specialists are in short supply, while demand for such talents keeps rising. Partnering with specialized software development vendors like Apriorit will help you quickly strengthen your team with rare domain expertise.

How Apriorit can help you implement AI in FinTech

Taking every project as a mission, Apriorit specialists have acquired a deep understanding of the FinTech industry and niche technical expertise in AI. We will strengthen your team with the exact knowledge and skills that you need to integrate AI-powered tools and features securely and efficiently.

Apriorit will gladly help you tackle any task your FinTech project may face when integrating AI:

- Quickly eliminate your talent and expertise shortage — Working with us, you get every expert you need in one place, from business analysts who will transform your vision into clear technical requirements to top-level architects, engineers, and quality assurance specialists who will turn your idea into a secure and competitive product.

- Customize and integrate AI solutions with your environment — Our specialists will help you select the most fitting AI model for your FinTech project, customize it, and improve its performance to fully meet your requirements. Taking a phased approach, we will ensure smooth and secure integration of AI-powered solutions with your existing systems.

- Test your AI model for bias — Apriorit’s AI professionals will validate the fairness of your AI model to ensure transparent, explainable, and bias-free predictions.

- Enhance AI model cybersecurity — With over 20 years of experience in cybersecurity, we can help your team choose and implement the most fitting improvements to secure anything from specific data types to the whole AI-powered system.

Read also

How to Use Big Data in FinTech: Benefits, Challenges, Implementation

See how FinTech companies unlock value through big data analytics and what technologies help them drive smarter financial decisions.

Conclusion

AI provides FinTech companies with the tools to operate efficiently, make strategic decisions, mitigate risks, and deliver outstanding customer experiences — all of which are essential for a business’s long-term resilience and growth. This technology creates a measurable impact across the financial sector, setting new standards for innovation in areas from AI-powered risk-scoring models to hyper-personalized customer support services.

However, AI adoption isn’t a simple plug-and-play exercise. It’s a challenging process that requires an expert team that can provide comprehensive AI consulting services, navigate regulatory concerns, manage data privacy and security, and ensure that AI predictions remain explainable and free from bias.

Unlock and leverage the full potential of AI-powered technologies for your next FinTech project with Apriorit. Working with us, you will gain a reliable AI and ML development partner to help you navigate this complex and challenging journey, from concept validation to model deployment and post-launch support.

Need a custom AI solution for your FinTech project?

Accelerate your innovation with Apriorit’s end-to-end AI and machine learning development services.