Key takeaways:

- Predictive analytics helps banks make smarter decisions, refine their development strategies, and cut operational costs.

- Successfully implementing predictive analytics requires blending AI, ML, big data, and statistical algorithms for stronger results.

- Predictive analytics solutions cover a range of use cases, from managing liquidity and assessing credit risk to optimizing portfolios.

- Creating a tailored predictive analytics solution is challenging since it demands a large quantity of high-quality data, continuous monitoring, and regular fine-tuning of the ML model.

- AI-powered predictive analytics systems require advanced cybersecurity measures and precise modeling, which are rarely ensured by off-the-shelf solutions.

Banking depends on foresight. AI-powered predictive analytics can help banks spot risks, forecast demand, and seize opportunities early. This enables fast, data-driven decisions that safeguard revenue and ensure compliance.

In this article, we explore the key benefits of predictive analytics in the banking industry, common challenges during integration, and practical considerations for successful adoption.

Whether you’re a product manager planning to implement predictive analytics or a financial software provider looking to enhance your solutions, this guide will help you navigate your journey.

Contents:

Predictive analytics in banking: What is it and why is it important?

Predictive analytics uses machine learning (ML) models and statistical algorithms to uncover patterns and predict future outcomes. In banking, it drives essential processes like credit risk assessment and fraud detection, empowering you to make faster, smarter decisions.

Traditional analytics looks backward, analyzing reports and historical data to explain past events. AI-powered predictive analytics looks forward, often combining historical and real-time data to forecast outcomes and help you take proactive steps to reduce risk.

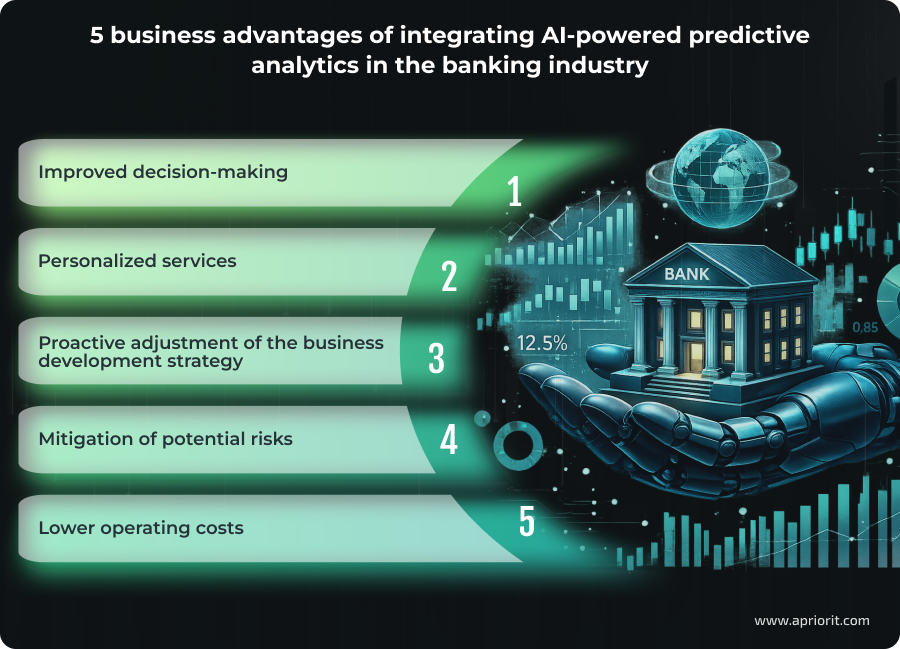

Insights derived from predictive analytics provide you with business benefits such as:

- Improved decision-making. Using ML algorithms to analyze large datasets reveals recurring events and hidden patterns across multiple factors. This empowers you to make faster, data-driven decisions. For example, spotting missed payments after a job change or income drop helps you to proactively restructure loans or start collections.

- Personalized services. AI-driven predictive analytics enable the identification of customer preferences and behavior by analyzing purchasing history, shifts in spending patterns, and decreases in account activity. This data lets you provide tailored services aimed at reaching customers’ financial goals and, as a result, increasing customers’ satisfaction and loyalty.

- Proactive adjustment of the business development strategy. The ability of ML models to process historical data alongside real-time data enables them to adjust forecasts based on new inputs, providing relevant projections in a changing environment. Based on these forecasts, you can precisely and proactively make changes to business strategies. For example, by forecasting demand for banking products by region using demographic data, economic indicators, and transaction trends, it’s possible to shape a bank’s geographic expansion strategy and open branches only in high-growth locations.

- Mitigation of potential risks. By monitoring a vast amount of financial data, predictive models can uncover indications of elevated risk. For example, location anomalies, account takeover indicators, and repeated transactions in the same amounts can be indicators of fraud. Such monitoring enables you to respond to early alerts and promptly mitigate high-risk situations.

- Lower operating costs. More accurate forecasts let you allocate resources efficiently and optimize their use, which can result in reduced costs. For example, a forecast for cash requirements allows for replenishing ATMs on demand, in a timely manner, and with the required amount of money. This lets banks lower costs for cash logistics, including any supplementary expenses.

Let’s explore what makes banking predictive analytics solutions so advanced.

Struggling to build secure FinTech software?

Leverage Apriorit’s expertise in financial systems, compliance, and data protection to develop reliable FinTech solutions tailored to your business goals.

Core technologies for predictive analytics in banking

When implementing predictive analytics software, your team can combine different technologies to handle vast datasets, detect patterns, and generate precise forecasts:

Statistical methods are designed to make forecasts based on historical data patterns. They involve:

- Exponential smoothing that builds forecasts based on a weighted average of past observations.

- Autoregressive integrated moving average (ARIMA), which forecasts time series data using such components as autoregressive, integrated, and moving averages, and seasonal ARIMA (SARIMA), which extends ARIMA to handle seasonal patterns.

- Linear regression methods that enable analysis of the linear relationship between two variables: for example, determining how interest rates affect loan demand.

ML and AI algorithms allow for analyzing vast datasets to forecast risks, customer behaviors, and market trends with higher accuracy than statistical methods. These algorithms include:

- Decision trees, which employ a hierarchical structure of decision nodes and branches to map out choices and outcomes. They are particularly effective in classifying risk levels for loans or identifying potentially fraudulent transactions based on a series of attribute-based decisions.

- Random forest, which uses multiple decision trees and combines their output to reach a single result through majority voting or averaging.

- Neural networks, which are aimed at identifying nonlinear relationships and subtle patterns within datasets. Neural networks allow for dynamic decision-making by reassessing risks in real time based on market fluctuations.

Big data frameworks such as Apache Hadoop and Apache Spark are designed to tackle the five Vs of data (volume, velocity, variety, veracity, and value), making them essential for predictive analytics in banking, where massive amounts of data are processed every day. These frameworks enable distributed processing, real-time streaming, and data cleansing, ensuring accurate, timely, and high-quality inputs for predictive models to deliver reliable insights.

Cloud platforms help to create scalable, secure, and cost-efficient environments for predictive analytics. They allow for storing vast amounts of data and scaling storage on demand. They also offer their own ML platforms, such as Azure Machine Learning and AWS SageMaker, with tools for everything from model training to MLOps. All these provide great possibilities for integrating advanced, effective, and reliable predictive analytics solutions.

Advancements in predictive analytics software have made it popular to use in the banking industry. Let’s see the range of use cases it covers.

Use cases of predictive analytics in banking

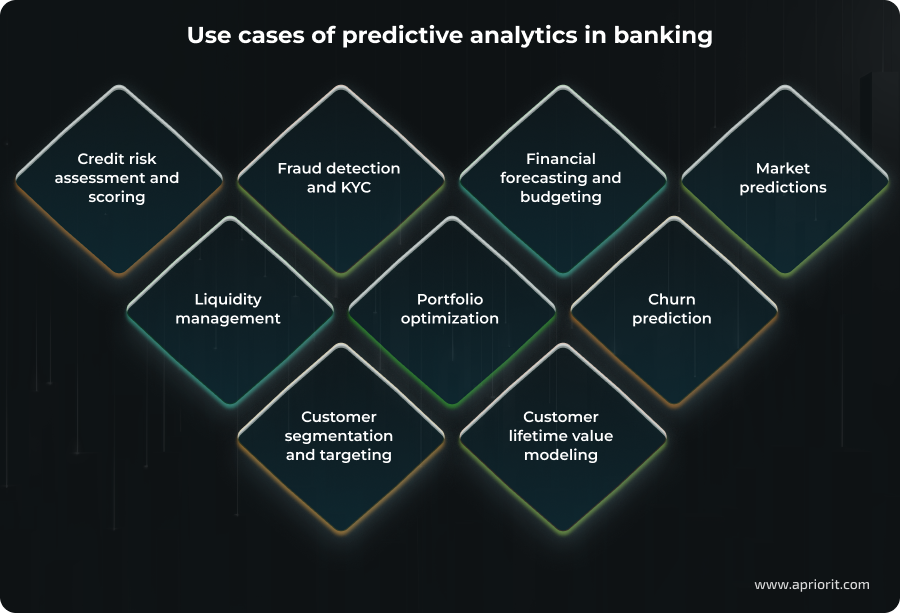

Depending on the business needs and goals, banking organizations integrate predictive analytics solutions to solve diverse issues, including:

1. Credit risk assessment and scoring

To get precise information on a customer’s creditworthiness, banks analyze income patterns, repayment history, and transaction behavior. For example, Santander uses predictive analytics to forecast early loan defaults.

2. Fraud detection and KYC

Predictive analytics solutions can help banks prevent fraudulent transactions and better implement Know Your Customer (KYC) standards. In particular, they let you monitor customers’ transactions in real time, improve KYC verification accuracy, and identify and take immediate measures against indicators of fraudulent activity. Such indicators can include multiple purchases across countries in a short time, sudden large withdrawals, activity outside typical hours, or using several cards for one order.

3. Financial forecasting and budgeting

By analyzing credit demand, macroeconomic trends, inflation, and customer behavior, predictive analytics helps you forecast income from loans, investments, and deposits. It also uncovers spending patterns across branches and departments to predict cost spikes, enabling quick budget adjustments and smarter financial planning, even in volatile markets.

4. Market predictions

Banks use predictive analytics to analyze market trends, forecast changes in interest and exchange rates, trace equity and bond price movements, and even perform sentiment analysis of mass media posts to indicate possible market shifts based on the policy tone. Leveraging such insights, you can make informed decisions as to future investments, loan pricing and deposit pricing strategies, and trading strategies.

5. Liquidity management

Predictive analytics helps you forecast cash flows based on historical payment cycles, customer behavior, and market trends. As a result, you can improve liquidity by predicting shortfalls or surpluses.

6. Portfolio optimization

By analyzing historical market data, financial indicators, and investor behavior patterns, you can predict asset correlations, identify potential investment opportunities, and forecast future market trends. These allow you to achieve more substantial risk-adjusted returns by optimizing asset portfolios.

7. Churn prediction

Analysis of transactional data, customer behavior, and interaction patterns helps banks identify customers at risk of leaving. Predictive analytics models compare current customer actions to past churn behaviors to discover potential churners. This analysis enables banks to implement proactive retention efforts, such as cashback or tailored services, to re-engage customers at risk.

Among predictive analytics examples in banking, American Express stands out for reportedly using an AI-driven analytics tool that analyzes customer data to forecast churn and identify factors leading to customer dissatisfaction. As a result, the bank has improved its customer retention.

8. Customer segmentation and targeting

AI-powered predictive analytics lets you identify complex underlying patterns and discover hidden customer segments, such as those based on customers’ spending habits and transaction patterns, products viewed, upcoming events (for example, education or retirement), and the likelihood of product acquisition. Such segmentation enables you to dynamically target customers with the right offerings, such as personal loans or mortgages, at the right moment.

9. Customer lifetime value modeling

Customer lifetime value (CLV) measures the total net profit a bank expects from a customer over their entire relationship, taking into account revenue from products, services, and fees. Predictive analytics enables precise CLV modeling by forecasting customer behaviors and financial trends, transaction patterns, credit scores, and engagement metrics, which can help you more accurately identify high-value clients and tailor personalized financial products to improve retention.

No matter the use case you have in mind, when planning to implement predictive analytics functionality, you may face a range of challenges that you must be prepared to overcome. Let’s examine them more closely.

Read also

AI in FinTech: Trends, Use Cases, Challenges, and Best Practices

Discover how AI is reshaping FinTech products by automating decisions, strengthening security, and enabling smarter personalization.

Challenges of implementing predictive analytics functionality in banking systems

In the process of developing a predictive analytics solution, you need to consider and mitigate a range of AI-specific risks to reach a result that meets your expectations and demands. Among the key challenges of building predictive analytics software are:

- Poor data quality and an insufficient quantity of data. Since customer data may be stored across different banking departments, combining and structuring it can be complex, resulting in reduced prediction accuracy. Moreover, a lack of financial data records can reduce the capabilities of analytical software. For example, it’s impossible to assess a customer’s creditworthiness without their credit history.

- Model drift and overfitting. Model drift occurs when accuracy drops over time due to changing data patterns or market conditions, leading to unreliable predictions in areas like credit scoring or fraud detection. Overfitting happens when ML models that learn training data too closely perform well historically but fail with new scenarios, such as evolving transaction behaviors or market shifts. Both issues make predictive analytics difficult in dynamic environments.

- Regulatory compliance barriers. Integrating predictive analytics into banking requires adherence to general and industry-specific requirements. For example, the GDPR limits the use of predictive analytics in banking when dealing with personal data, and PSD2 provides compliance rules that affect ML in FinTech, such as clear permission for data access and transaction processing. Regulatory bodies also guide AI explainability, requiring banks to provide transparency and the ability to explain automated decisions, especially those significantly impacting consumers (e.g., loan approvals, credit scoring).

- Cybersecurity risks. Large-scale analysis of sensitive data and the use of AI models and cloud infrastructure increase the attack surface and require proactive security measures.

- Integration with legacy systems. A lack of real-time data access, standardized APIs, and the scalability needed for ML models pose a significant obstacle for integrating predictive analytics software into outdated banking systems.

- Lack of skilled personnel. Implementing AI-driven predictive analytics software requires the engagement of experts in AI and data analytics who are capable of overcoming the listed challenges and delivering a secure and accurate solution. A lack of such talents can stall the process of integrating predictive analytics functionality.

Along with these challenges, consider the following Apriorit expert tips that will help you facilitate the predictive analytics implementation process.

How to smoothly integrate predictive analytics into banking systems: Apriorit tips

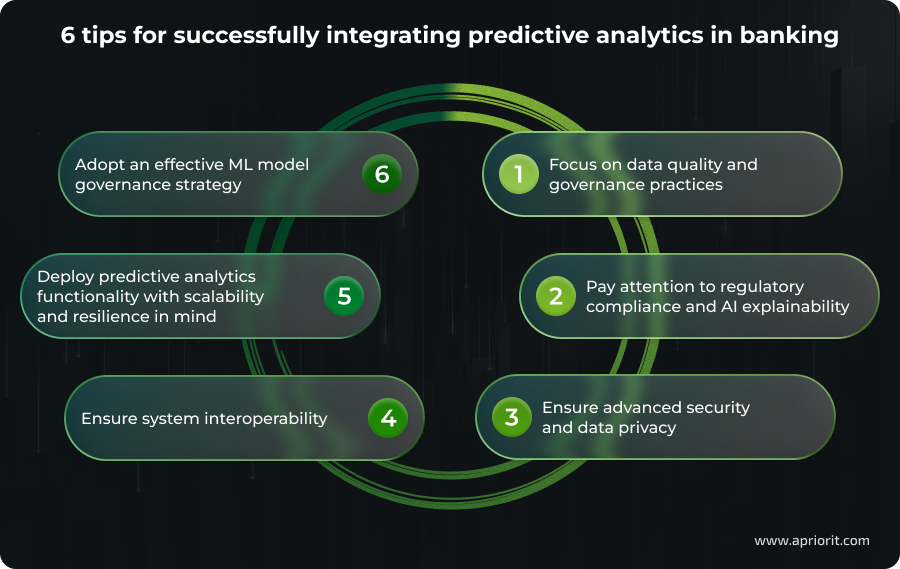

Let’s see what you should consider to build an effective, reliable, and secure solution that meets compliance requirements and your specific demands:

1. Focus on data quality and governance practices

The effectiveness of predictive analytics in the banking sector largely depends on the quality of data used for analysis and the volume of data processed.

It’s essential to collect and use data of appropriate quality from diverse sources. You can use structured and unstructured data from internal systems (transaction processing, call center logs, CRM data) and from external sources (credit history, public records, market data).

To maintain data quality, you need to implement robust data governance practices:

- Establish data stewards for every dataset to approve definitions and acceptable uses

- Build a centralized data catalog and metadata store, linking it to predictive analytics model inputs

- Automate checks in the data pipeline

2. Pay attention to regulatory compliance and AI explainability

To ensure data privacy and traceability of the AI model decision process, it’s important to meet the relevant compliance requirements when incorporating predictive analytics into banking systems. Such requirements can be region-specific (like the GDPR and the EU AI Act) or industry-specific (such as PCI DSS, KYC, and AML).

To integrate predictive analytics functionality in line with all applicable compliance requirements, do the following:

- Before building a predictive analytics model, identify all requirements that influence data, model design, explainability, and decision-making.

- Maintain documentation at every stage of software development: records justifying the choice of ML algorithm, data sources, customer consents, model training approach, and so on.

- Ensure AI explainability at the model level (how your model makes decisions in general) and at the case level (why your model made a specific decision), and guarantee that your explainability is auditable and reliable.

- Check regularly for algorithmic fairness: perform an algorithmic fairness review, implement bias metrics, and document fairness decisions.

- Conduct continuous monitoring of model performance, explainability drift, and incident reports.

3. Ensure advanced security and data privacy

Since predictive analytics software handles sensitive data, implementing advanced security and data privacy mechanisms is paramount.

To fortify your solution and ensure robust data protection, follow these recommendations:

- Implement role-based access control and least privilege principles

- Audit all access events

- Encrypt banking data at rest, in transit, and in use

- Apply data minimization principles

- Use privacy-preserving data transformation techniques like anonymization, pseudonymization, or creating synthetic data for development and testing

- Secure the environment you use for analysis, such as by implementing network segmentation, enhancing cloud security, and automatically scanning for vulnerabilities

- Implement third-party risk management

4. Ensure system interoperability

For reliable communication and data exchange, it’s important to ensure seamless interoperability between ML models, data pipelines, legacy systems, and so on.

To provide smooth system interoperability, consider doing the following:

- Implement an API-driven architecture

- Use microservices for containerization of legacy components

- Leverage standardized data schemas

- Implement centralized data platforms

- Enforce consistent identity and security standards, such as TLS encryption across all your system’s components and centralized identity and access management

5. Deploy predictive analytics functionality with scalability and resilience in mind

Since predictive analytics in banking is used for critical tasks like fraud detection and credit scoring, it’s paramount to deploy such systems in a highly available, scalable, and resilient way.

Depending on your regulatory and technological landscape, you can go with a cloud-native, on-premises, or hybrid deployment.

For example, if you opt for a cloud-native model, you can:

- Rapidly deploy your predictive analytics functionality, including across a multi-cloud environment

- Ensure instant scalability of your predictive analytics solution on demand

- Continuously update your predictive analytics model without downtime

- Enable real-time analysis by continuously running a predictive analytics model in the cloud

- Eliminate heavy infrastructure investments

- Automatically handle system failovers

A cloud-native deployment model also involves using containerization for horizontal scaling and microservices for individual scaling, allowing you to manage the load efficiently.

Alternatively, you can choose a hybrid cloud model in cases when:

- Sensitive data must stay on-premises (for example, if data must be stored within national borders) but you need fast access to AI services or want to train an ML model in the cloud without incurring high hardware costs. This way, you gain cloud benefits without moving sensitive data.

- You want to boost system resilience and make your on-premises infrastructure serve as a fallback if cloud access is disrupted.

6. Adopt an effective ML model governance strategy

To ensure that your predictive analytics solution is accurate, fair, stable, and meets compliance requirements, it’s essential to adopt a continuous and effective ML model governance strategy.

To establish successful ML model governance, consider the following:

- Continuous performance monitoring to track the deviation of performance metrics from set thresholds

- Monitoring for model fairness and detecting bias

- Fine-tuning the ML model in cases of performance degradation, such as an increase in false positives, model drift, or changes to compliance requirements

To smoothly integrate predictive analytics into your banking system, it’s essential to entrust the development to specialists with relevant expertise in FinTech software development, AI and ML, data analytics in the banking domain, and cybersecurity. Let’s see how Apriorit professionals can help you with that.

Read also

How to Build a Custom Know Your Customer (KYC) System for Your FinTech Product

Find out how you can streamline compliance and proactively detect risks by adopting AI-driven KYC software.

How Apriorit can help integrate predictive analytics into your banking system

Apriorit has extensive expertise in building FinTech and AI-based solutions and provides full-cycle software development that adheres to the principles of a secure SDLC. Among our wide range of services, we can offer you:

- FinTech software development. We have extensive expertise in creating diverse FinTech solutions that are tailored to your business demands and industry-specific compliance requirements — from building digital payment apps to integrating predictive systems with core banking, CRM, and data warehouses.

- AI and ML development. Our experts in AI and ML ensure secure integration of a predictive analytics model to your banking system, including ML algorithm selection, model training, testing, and deployment.

- Big data. If you want to leverage big data methods to implement predictive analytics software, Apriorit specialists can help you integrate big data analytics tools, ensuring protected data storage.

- Cybersecurity. With more than two decades of specialization in developing cybersecurity solutions of any complexity, we’ll implement strong security mechanisms and follow advanced practices to enhance data protection and fortify the overall security of your solution.

- Support and maintenance. Apriorit professionals provide a full range of post-release services to keep your predictive analytics solution secure, accurate, and reliable. Such services include fine-tuning models, extending a solution’s functionality, migrating to the cloud and upgrading cloud environments, delivering security updates, modernizing legacy software, and more.

You can also choose the cooperation model that works for you: time and materials, dedicated team, or fixed price. Our experienced project managers will ensure the project stays within the agreed budget and timelines.

When partnering with Apriorit, you can access our entire spectrum of services to build a secure, reliable, and efficient predictive analytics solution.

Looking for a partner with experience developing predictive analytics solutions?

Reach out to Apriorit experts to build accurate and effective software. We’ll help you meet your business goals and ensure top-notch data protection.

FAQ

How can predictive analytics help banks forecast financial market trends and maintain a competitive edge?

<p>By combining historical data, real-time signals, and advanced modeling, banks can forecast trends with greater accuracy and act faster than rivals.</p> <p>For instance, predictive models can anticipate interest rate fluctuations, predict asset price movements and market volatility, and spot emerging sectors early. This foresight gives banks time to make informed decisions and adjust investment strategies and portfolios proactively.</p>

Which data governance practices improve data reliability and compliance for predictive analytics models?

Among the core practices that can help improve data reliability and compliance for predictive analytics models are:

<ul class=apriorit-list-markers-green>

<li>Data profiling and cleaning to detect anomalies, inconsistencies, and duplicates</li>

<li>Continuous monitoring with automated alerts and AI-driven anomaly detection to maintain data freshness and prevent degradation over time</li>

<li>Metadata management and lineage tracking to provide full traceability, allowing audits to verify data transformations and sources</li>

<li>Implementation of data stewardship roles, role-based access controls, and customer consent tracking to protect data and ensure compliance with privacy requirements</li>

</ul>

What are the main challenges in embedding predictive analytics into existing business workflows?

When embedding predictive analytics into existing business workflows, you may face significant hurdles, particularly in banking. The main challenges include:

<ul class=apriorit-list-markers-green>

<li>Poor data quality and not enough data: Missing, biased, or outdated data reduces model accuracy</li>

<li>Complexity of integrating predictive analytics models with legacy systems</li>

<li>Shortage of data scientists, ML engineers, and analytics translators</li>

<li>Degradation of predictive analytics models over time as conditions change</li>

<li>Compliance difficulties: Predictive analytics models must meet regulatory, ethical, and security standards that slow down their deployment</li>

</ul>

Which is more effective: building predictive analytics in-house or outsourcing to FinTech software development experts?

<p>Both options have their advantages. For example, you can build predictive analytics software using in-house capabilities when you have corresponding data scientists, engineers, and domain experts, or if you want to precisely tailor the model to proprietary data and business processes.</p> <p>On other hand, outsourcing development to a reliable vendor ensures faster deployment and quicker ROI, access to specialized expertise and proven solutions, lower upfront costs, and exposure to cutting-edge AI and analytics techniques.</p>

What are the best practices for handling sensitive customer data in predictive analytics while meeting compliance requirements?

Handling sensitive customer data in predictive analytics in accordance with compliance requirements (such as the GDPR, CCPA/CPRA, and similar laws and regulations worldwide) requires a combination of legal compliance, technical controls, and strong governance. Best practices used by banks and data-driven organizations include:

<ul class=apriorit-list-markers-green>

<li>Applying data minimization by design: Only collect and use data that is strictly necessary for analytics purposes</li>

<li>Embedding privacy controls into analytics systems from the start</li>

<li>Using anonymized or pseudonymized data for model training</li>

<li>Implementing strong access controls and role-based permissions like RBAC, MFA, and the principle of least privilege</li>

<li>Encrypting data at rest and in transit</li>

<li>Ensuring customer data is used only as agreed</li>

<li>Monitoring for bias and fairness, especially in automated decisions</li>

<li>Aligning data retention periods with legal requirements</li>

<li>Conducting regular security and privacy reviews</li>

<li>Performing regular vendor security assessments</li>

<li>Training your team on data privacy</li>

</ul>